Click above to watch Pinnacle Digest’s year end video. See where we’ve been, and where we are headed next year…

2018 is coming to a close amidst a volatile and declining U.S. stock market. However, the 15-20% declines in major indices such as the NASDAQ and S&P (from their summer highs) are minor compared to the carnage on Canada’s TSX Venture and CSE exchanges. While the Venture is down roughly 40% from its highs in January, the CSE is down over 60%.

Negative sentiment aside, we are cautious optimists at this moment, and think it’s for good reason. In case you missed our letter from last week, find out why we are now turning bullish, at least for the short-term (click here).

What to Expect if U.S. Stocks Enter Bear Market?

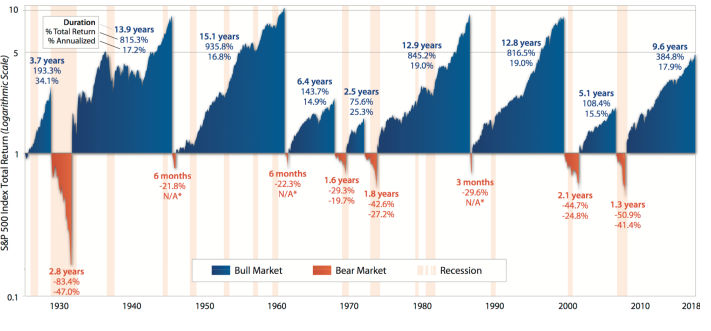

For some context, historical data shows that bull markets last much, much longer than bear markets.

According to FT Portfolios, when it comes to U.S. bull and bear markets for the S&P 500, between 1926 and September of 2018,

“The average bull market period lasted approximately 9.1 years with an average cumulative total return of 480%.

The average bear market period lasted roughly 1.4 years with an average cumulative loss of -41%.”

CNBC stated, “In the average correction, the market fully recovered its value within an average of 10 months, according to Azzad Asset Management.”

These results are based on monthly returns-returns using different periods would produce different results. This chart is for illustrative purposes only and not indicative of any actual investment. These returns were the result of certain market factors and events which may not be repeated in the future. Past performance is no guarantee of future results.

In short, be an opportunistic trader and pick your spots. Be aware of seasonality factors and geopolitical issues this coming year as they will drive the broader equity markets. We intend to be nimble with virtually all our equity positions.

We expect significant volatility to continue in 2019. However, contrary to many market pundits’ commentary, a U.S. recession is far from certain next year. Finally, with a collapsing stock market, most financial headlines are negative at the moment… there’s often opportunity for quick market bounce backs when faced with this level of investor fear.

Before you shut it all down for the holidays, sit back and enjoy our year end video below…

Click above to watch our year end video. See where we’ve been, and where we are headed next year…

Thank You

2018 was a year of fantastic subscriber growth and continued support from our long-time readers and viewers. After more than ten years in this game, we want to thank every one of you for reading and watching our exclusive content geared toward Canada’s diverse small and micro-cap markets. You drive our focus, motivate us, and it’s your feedback which has made Pinnacle Digest one of Canada’s leading small cap publications. We have many new product and feature launches planned for 2019, all intended to enhance the value we bring to you, our loyal subscribers.

With the holidays upon us, and this being our last letter of the year, we wish you and yours all the very best. Take time to relax, reminisce on 2018, and recharge for the coming year. It’s going to be a fun one.

Merry Christmas and Happy New Year!

PINNACLEDIGEST.COM