A Silver Story in Mexico’s Nayarit Region

With approximately CAD$12.5 million in the bank1 as of June 30, 2021, our client, Sierra Madre Gold and Silver Ltd. (“Sierra Madre” or the “Company”) (SM:TSXV), is an exploration company run by an experienced management team with a history of successful deal execution in Mexico. The Company’s team of professionals have collectively raised over 1 Billion CAD for mining companies in the past. With respect to Sierra Madre, they have negotiated acquisition terms2 for two Mexico-based projects.

The Company’s most recent financing (roughly CAD$15 million) was completed in October, 2020 at a price of CAD$0.50 per share. Sierra Madre’s shares last traded for CAD$0.51. Its 52-week high is CAD$1.14, and its 52-week low is CAD$0.41.

Recent Insider Buying: The Company’s CEO, Mr. Alex Langer, and its Executive Chairman, Mr. Gregory Liller, have both recently bought shares in Sierra Madre. The insider transactions occurred in early September and as recent as late-October for prices ranging from CAD$0.45 to as high as CAD$0.64 per share.

CEO: Mr. Alex Langer was Co-Founder and Vice President of Prime Mining (TSXV) and Millennial Lithium (TSXV), where he handled Capital Markets for both companies. Last week, Lithium Americas made an offer3 to acquire Millennial Lithium. The bid (stock-and-cash offer) for Millennial Lithium represents a total consideration for the Company of approx. US$400 million.

CEO: Mr. Alex Langer was Co-Founder and Vice President of Prime Mining (TSXV) and Millennial Lithium (TSXV), where he handled Capital Markets for both companies. Last week, Lithium Americas made an offer3 to acquire Millennial Lithium. The bid (stock-and-cash offer) for Millennial Lithium represents a total consideration for the Company of approx. US$400 million.

Executive Chairman: Over the course of his career, Mr. Gregory Liller has played a key role in the discovery and development of more than 11Moz Au and 600M oz Ag combined reserves and resources and securing over $300 million dollars in equity financings and $100 million dollars in debt financing.

We own shares of Sierra Madre and intend to add to our position this coming week. Watch our exclusive video on Sierra Madre below to learn about the Company and its objectives in Mexico.

Click here to visit the Company online.

About the Company

Sierra Madre Gold and Silver Ltd. is a mineral exploration company, currently focused on the acquisition, exploration and development of the Tepic and La Tigra Properties in Nayarit, Mexico. The Company has an experienced management team with a proven track record of wealth creation in Mexico through project discovery, advancement, and monetization. Sierra Madre’s key objective is to advance exploration on the Tepic and La Tigra Properties to determine whether they contain commercially exploitable deposits of precious or base metals.

1As stated in Sierra Madre’s Interim Management’s Discussion and Analysis for the six months ended June 30, 2021.

2Cream Minerals de México S.A. de C.V. granted Sierra Madre an Option (“Option Agreement”) for the exclusive right to purchase 100% of the ownership and rights related to the Tepic Project. Please read Sierra Madre’s Non-Offering Prospectus dated March 31, 2021 for information on the terms of the Option Agreement. The Non-Offering Prospectus can be found on www.sedar.com under the Company’s issuer profile. Click here for information about the acquisition terms of Sierra Madre’s La Tigra Project.

3Click here and here for information about details of the offer to acquire Millennial Lithium.

Silver: The Forgotten EV Metal

For the most part, enabling the green energy revolution is about one thing: Metals.

The efforts to decarbonize an increasingly energy-dependent world is giving rise to darlings among certain metals at the expense of several others. Cobalt, lithium and graphite are among today’s favoured metals (aka green metals) and so is copper, nickel, and the subject of this week’s Intelligence Newsletter: Silver.

Before we dive in, consider the following…

Tesla now has a market cap above US$1 trillion, and its founder, Elon Musk, has a net worth of more than US$300 billion. He is far and away the richest man in the world today. Closest to Musk is Jeff Bezos, with around US$195 billion to his name. If you’ve ever wondered how Musk’s Tesla is generating way more momentum than practically every one of its peers, the chart below provides an answer.

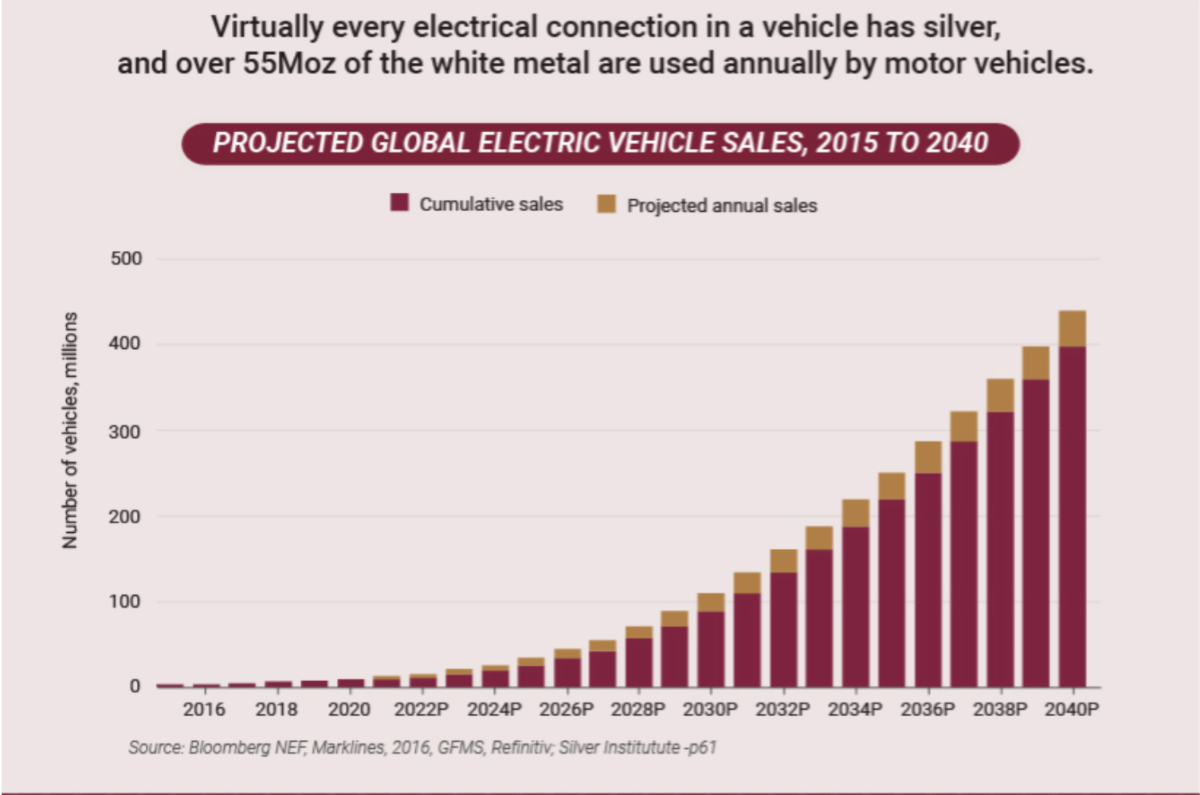

We are at the very early stages of an electric vehicle adoption trend that will see tens of millions and ultimately hundreds of millions of EVs hit the road across the globe.

As the pioneer and reigning EV standard-bearer, investors have been throwing their weight behind Tesla. Investors have bet that the company will acquire a massive market share in the future, as Tesla aims to radically change the transportation industry. Regardless of whether the Tesla bulls are right or wrong, no EV company will rise to the top without the aid of silver.

Enter Silver: The EV Metal

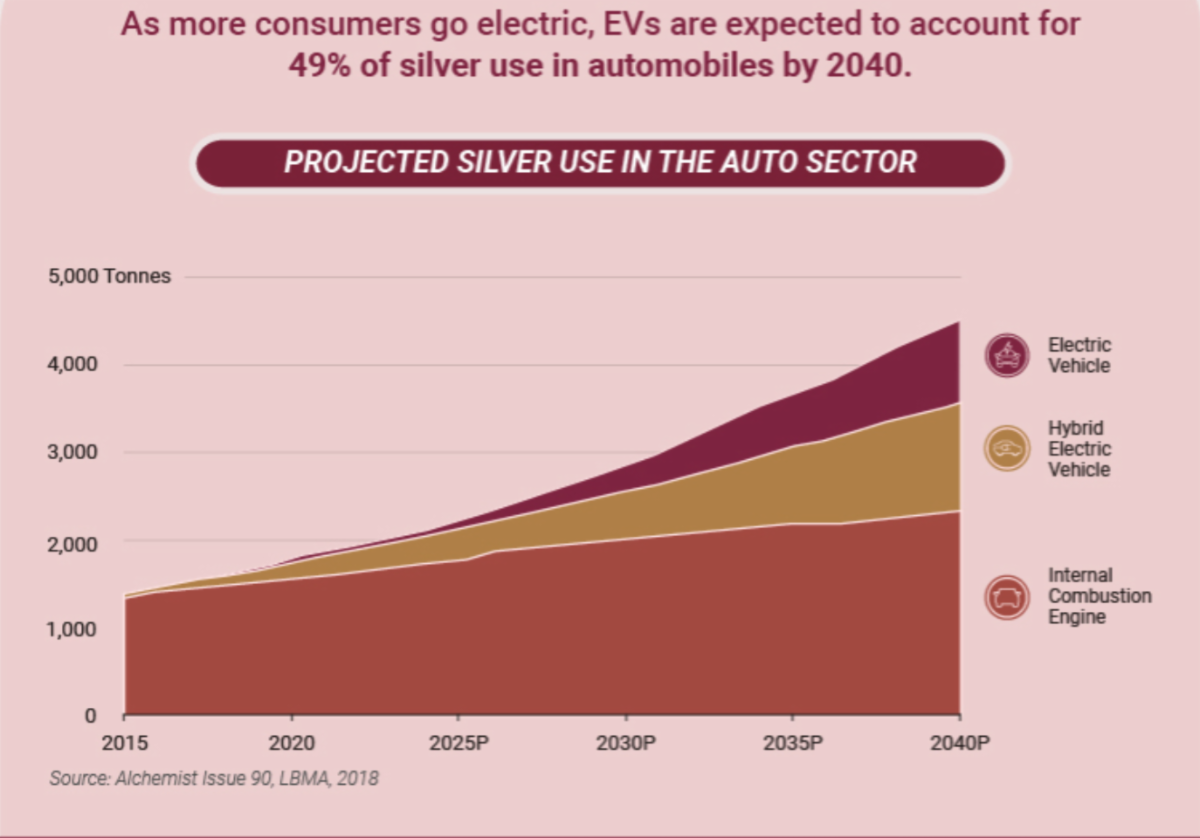

As spelled out in the chart above, virtually every electrical connection in a vehicle has silver. So, while metals such as lithium, cobalt, and nickel are arguably the more storied green metals, silver also stands to gain significantly from the EV sector’s growth.

For starters, silver has the highest electrical & thermal conductivity, and reflectivity of any metal. Remarkably, some estimates have EVs accounting for almost half of all silver use in automobiles by 2040.

The automobile sector’s direct silver demand is expected to move from just over 1,000 tons in 2015 to 4,500 tons in 2040. That means almost 160 million ounces of silver will be required to support the EV and Hybrid EV markets alone in the next 20 years.

Reporting on data from the Silver Institute, Nithin Prasad of Mercom India highlights the demand forecast for silver in EVs:

“[Internal Combustion Engines]ICE-based vehicles use anywhere between 18 – 34 grams of silver per light vehicle, and battery electric vehicles are expected to use between 25 – 50 grams per vehicle, per the report.”

Such significant increase in silver per vehicle will underpin demand for decades to come. As the number of electric cars manufactured increases, so will the need for silver.

In his recent article, PolicyAdvice contributor, Alex Kopestinsky, shared some forecasts about the coming use of electric cars worldwide:

“The latest report by Bloomberg New Energy Finance shows that by 2040, 58% of global passenger vehicle sales will come from electric vehicles. At the same time, they will make up less than 33% of all the cars on the road.”

He also pointed out that,

“The report shows that electric vehicles (EVs) currently make up only 3% of car sales worldwide. By 2025 electric vehicles (EVs) will reach 10% of global passenger vehicle sales, growing to 28% in 2030 and 58% by 2040.”

With 2040 roughly 18 years away, the rise of the EV sector is looking bullish for silver.

Solar’s Silver Lining

It’s not all happy days for the silver industry. Prasad’s report on Mercom India warned that,

“According to The Silver Institute, the amount of silver used in PV has reduced from 521 milligrams (mg) per cell in 2009 to about 111 mg in 2019. It expects this to drop further to 80 mg per cell by 2024.”

That said,

“The Silver Institute also said that the savings made using substitutes were offset by the lower efficiency and the consequent need for more panels to match capacity.”

Forbes Councils member, Tyler Gallagher, noted a potential upside for PVs when it comes to silver,

“Due to efficiency upgrades, some new PV cells will require as much as 50% less silver than current panels.”

But that,

“Nonetheless, the ramping up of solar panel production might offset the demand losses incurred by more efficient panel technology.” He also reminded readers that, “In the U.S., solar energy is expected to comprise 48% of renewable power in 2050 (up from 11% in 2017).”

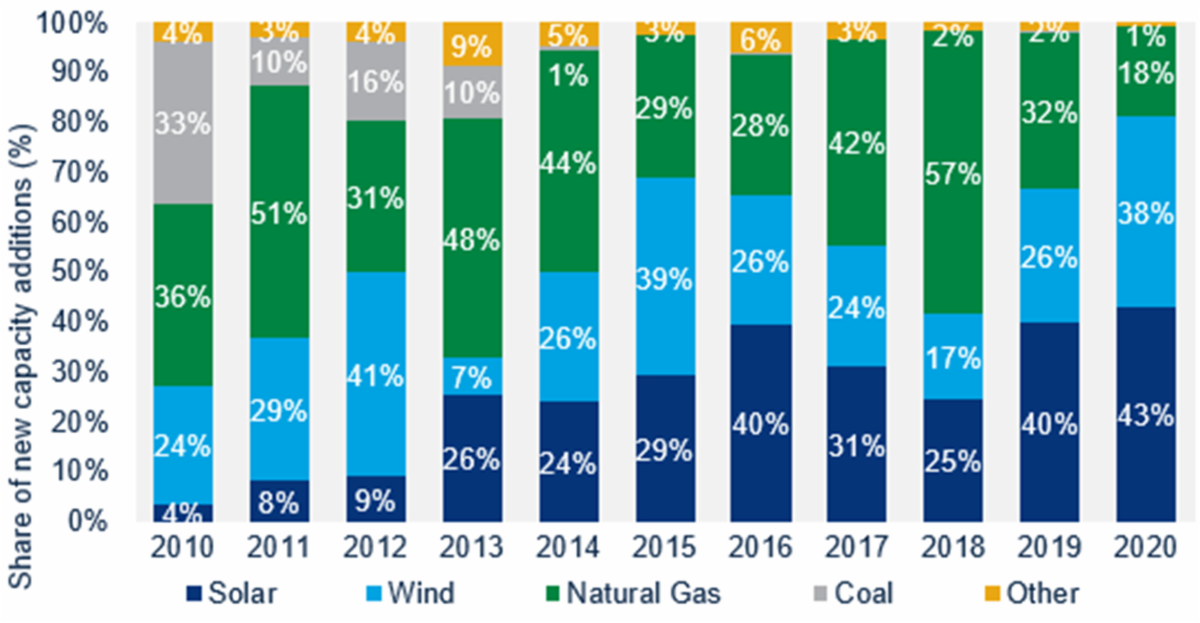

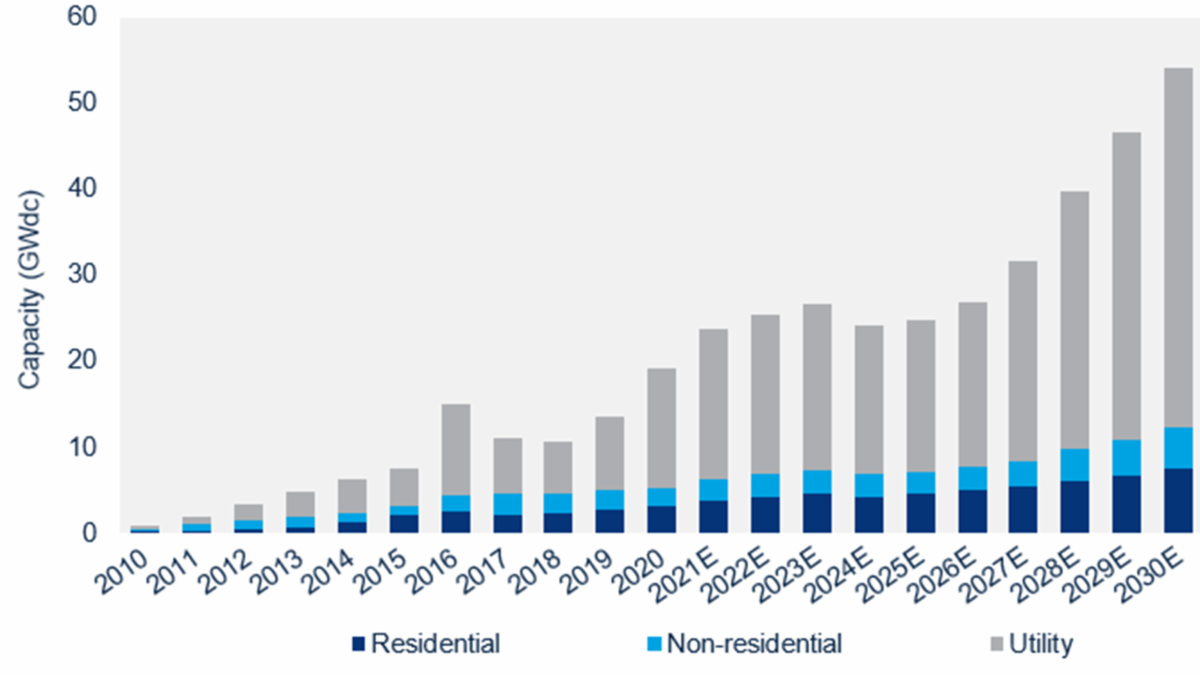

We wrote about all renewables and why the solar sector would win out in The Rising Star of the New Economy in October of 2021. Solar continued to outperform all other renewables and had a breakout year in 2020, accounting for 43% of new capacity.

New U.S. electricity-generating capacity additions over the last decade

U.S. solar PV installations and forecast, 2010-2030E

So, if expectations play out and solar can continue to boom, silver will most likely benefit.

Back to Silver

The Silver Institute forecasts that demand for silver will increase by 11% in 2021. It expects physical investment in the metal to hit a six-year high of approximately 260 million ounces this year.

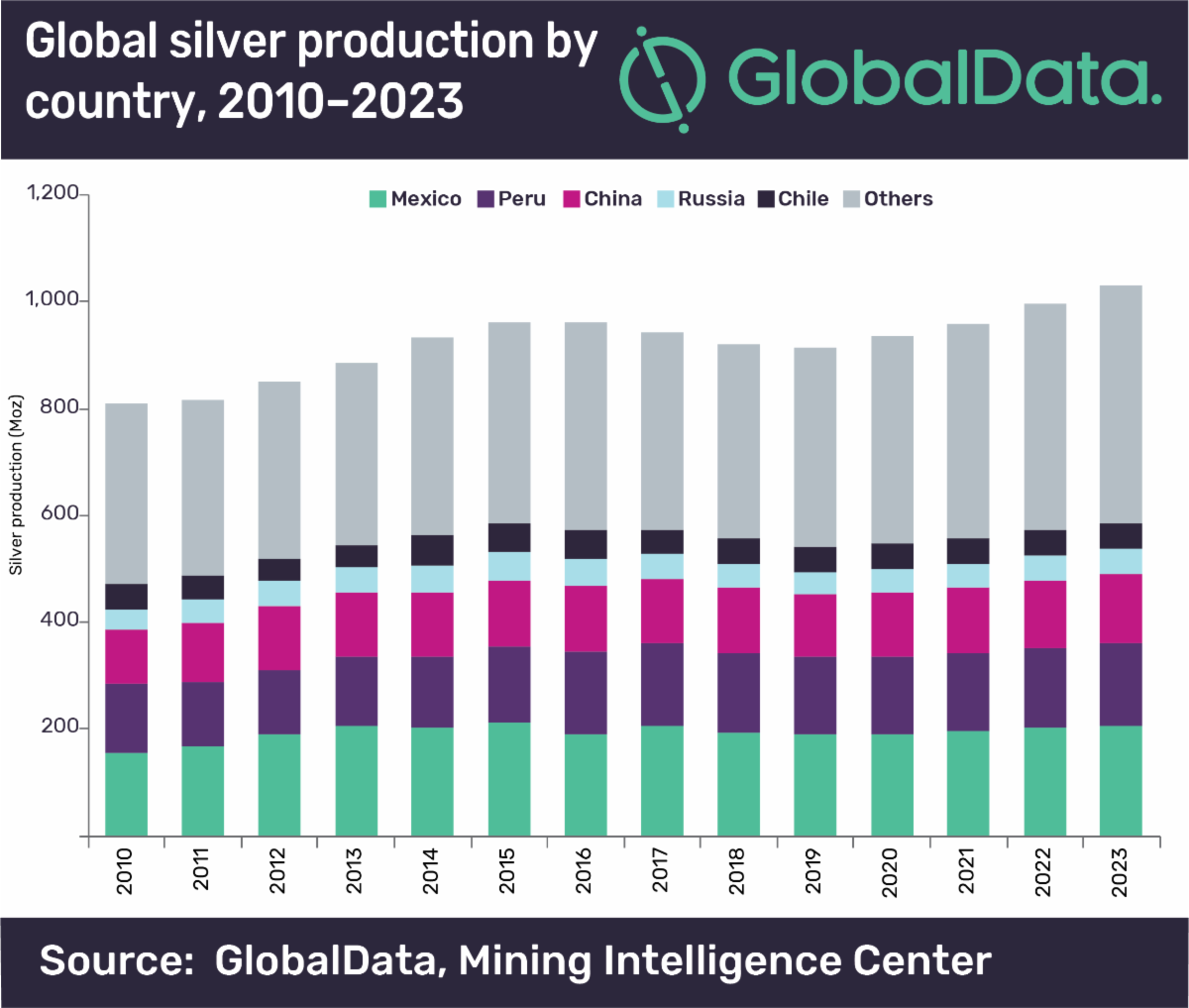

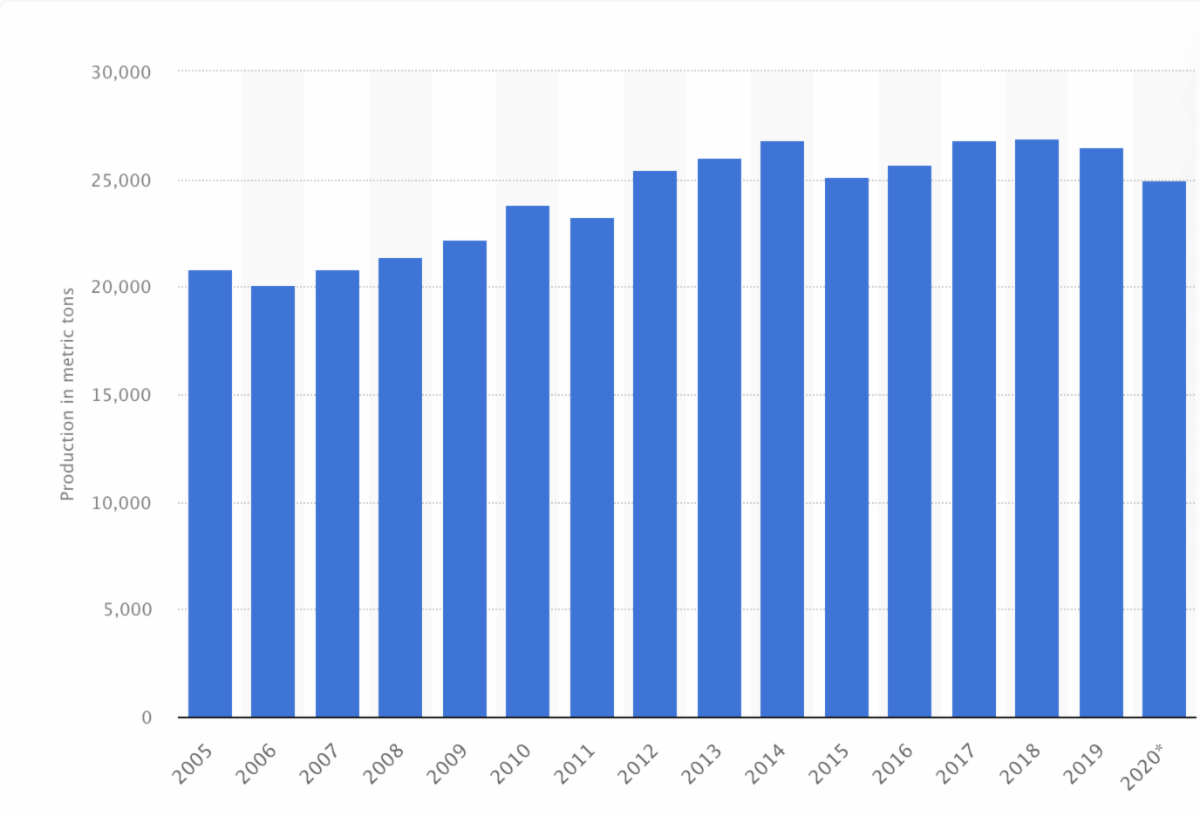

Despite steadily increasing demand, silver production levels have remained essentially flat over the last 15 years.

Global mine production of silver from 2005 to 2020 (in metric tons)

About half of all silver produced comes from just three countries: Mexico, Peru, and China. Whenever this is the case, it lends itself to potential price swings and increased volatility.

And now, after several years of steady decline in mine output for silver, global silver production is expected to increase about 8% in 2021 to roughly 918 million ounces and then exceed one billion ounces by 2024, according to GlobalData.

So, despite global production finally picking up, demand for silver is forecast to be robust in the coming years due to the expanding solar and EV markets.

Of course, the last factor supporting silver is inflation. For decades, silver has been viewed by many as a hedge against inflation. And with many metals, from copper to palladium, recently spiking in value, it’d be reasonable to expect that silver could have its moment in the not-so-distant future.

All the best with your investments,

PINNACLEDIGEST.COM

Disclosure, Compensation, Risks Involved and Forward-Looking Statements:

You must read the following carefully before proceeding.

THIS REPORT IS NOT INVESTMENT ADVICE OR A RECOMMENDATION TO PURCHASE ANY SECURITY. IT IS NOT INTENDED TO BE A COMPLETE OVERVIEW OF SIERRA MADRE GOLD AND SILVER LTD. THE INFORMATION IN THIS REPORT IS NOT A SUBSTITUTE FOR INDEPENDENT PROFESSIONAL ADVICE. SEEK THE ADVICE OF YOUR FINANCIAL ADVISOR AND A REGISTERED BROKER-DEALER BEFORE MAKING ANY INVESTMENT DECISIONS.

All statements in this report are to be checked and verified by the reader.

This report may contain technical or other inaccuracies, omissions, or errors, for which Maximus Strategic Consulting Inc., owner of PinnacleDigest.com (“Pinnacle Digest” or “Maximus” or “we” or “us”), assumes no responsibility. We cannot warrant the information contained in this report to be exhaustive, complete or sufficient. This report does not purport to contain all the information that may be necessary or desirable to fully and accurately evaluate an investment in Sierra Madre Gold and Silver Ltd. (“Sierra Madre” or the “Company”). Sierra Madre is a client and sponsor of PinnacleDigest.com. PinnacleDigest.com authored and published this report. Because we are paid by Sierra Madre, and therefore we are not independent reporters, our coverage of Sierra Madre features many of its positive aspects, and not the potential risks to its business or to investing in its stock.

Important: Our disclosure for this report on Sierra Madre Gold and Silver Ltd. applies to the date this report was posted on our website (November 7, 2021). This disclaimer will never be updated, even if we buy or sell shares of Sierra Madre Gold and Silver Ltd.

Do Your Own Due Diligence: An investment in securities of Sierra Madre should only be made by persons who can afford a significant or total loss of their investment.

In all cases, interested parties should conduct their own investigation and analysis of Sierra Madre, its assets and the information provided in this report. Readers should refer to Sierra Madre’s public disclosure documents found on the SEDAR website (www.sedar.com) before considering investing in the Company. The public disclosure documents will help investors understand Sierra Madre’s objectives and the risks associated with the Company.

The securities of Sierra Madre are highly speculative due in part to the nature of the Company’s plans/objectives and the present stage of Sierra Madre’s development. The Company has no history of generating revenue and the exploration of its mineral properties/projects is at an early stage. Therefore, it is subject to many risks common to comparable companies, including a lack of revenue, under-capitalization, cash shortages, and limitations with respect to personnel, financial and other resources. Without operating revenue, the Company is subject to liquidity risk and dependent upon meeting its future capital requirements through the issuance of capital stock. Failure to obtain additional financing could result in the delay or indefinite postponement of further exploration and development or the possible loss of the Company’s properties/projects. A prospective investor should consider carefully the risk factors set out in this disclosure statement and outlined in the Company’s annual and quarterly Management’s Discussion and Analysis, and in other filings made by Sierra Madre with Canadian securities regulatory authorities available at www.sedar.com.

Important: Please be aware and note the date this report was published (November 7, 2021). As a result of the passing of time, the relevancy of the opinions and facts in this report are likely to diminish and may change. As such, you cannot rely on the accuracy and timeliness of the information provided in this report. Since there is no specific guideline as to how long this report may remain relevant, you should consider that it may be irrelevant shortly after its publication date.

Cautionary Note Regarding Forward-Looking Information:

This report contains “forward-looking information” within the meaning of Canadian securities legislation (collectively, “forward-looking statements”). All statements, other than statements of historical fact, that address activities, events or developments that Sierra Madre or Pinnacle Digest believes, expects or anticipates will or may occur in the future are forward-looking statements. Such forward-looking statements also include, but are not limited to, statements regarding: the planned exploration of Sierra Madre’s projects; demand for silver continuing to outpace supply; historical estimates of mineralization; new high-grade resources becoming sought-after assets in the mining industry; prospective targets for drilling and other exploration work; the growth potential of any deposits or trends; the size, quality and timing of Sierra Madre’s exploration and development plans; potential mineral resources at Sierra Madre’s project(s); the estimation of mineral resources; the prospect of preparing a technical report containing a mineral resource estimate, and the timing thereof; Sierra Madre’s Tepic project having significant expansion potential; future trends; any comparisons of Sierra Madre’s projects to other mineral projects not owned by the Company; the potential or likelihood of making a new discovery; information with respect to Sierra Madre’s potential future production from, and further potential of, the Company’s project(s); Sierra Madre’s future financial position and budgets; potential future revenue or business models; general plans for the La Tigra and Tepic projects; Tepic being a hub for Sierra Madre’s business objectives, including the potential acquisition and consolidation of mines in the surrounding area; community support and social licence for Sierra Madre’s activities and initiatives; estimates of project economics; forecasts; the future price of minerals, particularly silver and gold; funding availability; investor sentiment; conclusions of economic evaluation; capital expenditures; inflation and its potential benefits to silver and to companies such as Sierra Madre; mineralization projections; mining or processing issues; currency exchange rates; government regulation of mining operations; taxes; catalysts that might warrant a potential re-rate of the Company’s shares; the Company receiving assay results and the timing of any assay results being released to the public; Sierra Madre being able to find material mineral deposits in the future; Sierra Madre receiving any necessary permits for its operations in the future; the timing and likelihood of Sierra Madre achieving objectives and development plans, and projected costs of development.

Relating to exploration, the identification of exploration targets and any implied future investigation of such targets on the basis of specific geological, geochemical and geophysical evidence or trends are future-looking and subject to a variety of possible outcomes which may or may not include the discovery, or extension, or termination of mineralization. Further, areas around known mineralized intersections or surface showings may be marked or described by wording such as “open”, “untested”, “possible extension” or “exploration potential” or by symbols such as “?”. Such wording or symbols should not be construed as a certainty that mineralization continues or that the character of mineralization (e.g. grade or thickness) will remain consistent from a known and measured data point. The key risks related to exploration in general are that chances of identifying economical reserves are extremely small.

Often, but not always, these forward-looking statements can be identified by the use of forward-looking terminology such as “expects”, “expected”, “budgeted”, “targets”, “forecasts”, “intends”, “anticipates”, “scheduled”, “estimates”, “aims”, “will”, “believes”, “projects”, “could”, “would”, and similar expressions (including negative variations) which by their nature refer to future events.

By their very nature, forward-looking statements are subject to numerous risks and uncertainties, some of which are beyond Sierra Madre’s control. These statements should not be read as guarantees of future performance or results because a number of assumptions and estimates have been made, and they may prove to be incorrect. Forward-looking statements are based on the opinions and estimates of Sierra Madre’s management or Pinnacle Digest at the date the statements are made. In this report, assumptions and estimates may have been made regarding, among other things, the presence of, and continuity of, mineralization at Sierra Madre’s projects not being fully determined; the availability of personnel, machinery and equipment at estimated prices and within estimated delivery times; currency exchange rates; metals sales prices; tax rates and royalty rates applicable to the Company’s property interests; present and future business strategies and the environment in which the Company will operate in the future; the Company receiving regulatory and governmental approvals for its mineral properties/projects on a timely basis; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; maintaining the concessions for the Company’s current and future mineral properties/projects; anticipated costs; supply and demand for the Company’s primary metals; the level and volatility of metals prices; general business and economic conditions not changing in a material adverse manner; the potential of the Company’s projects to contain economic mineral deposits; community support for Sierra Madre’s activities and initiatives; exploration timetables and capital costs for the Company’s exploration plans being correctly estimated and/or unaltered by unforeseen circumstances; the Company maintaining its ongoing relations with the other parties to the option agreements on the Tepic and La Tigra projects; the current and future social, economic and political conditions in Mexico; the anticipated timing of results from various work programs; the Company’s ability to meet its working capital needs for the short term; the availability of acceptable financing; general interest in gold and silver companies; inflation; success in realizing proposed operations, and other assumptions and factors generally associated with the mining and exploration industry.

While such estimates and assumptions are considered reasonable by Pinnacle Digest, they are inherently subject to significant business, economic, competitive and regulatory uncertainties and risks.

Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of Sierra Madre to differ materially from those discussed/written in the forward-looking statements in this report and, even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, Sierra Madre. Factors that could cause Sierra Madre’s results to differ materially from those expressed in forward-looking statements in this report include, but are not limited to, the following risks and uncertainties: unanticipated developments in business and economic conditions in the principal markets for commodities and/or financial instruments; failure to achieve the Company’s exploration and development targets; changes in the supply, demand, and prices for silver, gold, and other commodities; the actual results of exploration and development activities; conclusions of economic evaluations; uncertainty in the estimation of mineral resources and reserves; environmental and reclamation liabilities, risks, hazards and regulatory requirements; adverse weather conditions; legal disputes; not detecting deposits that may be of economic interest; the interest of the Company in its properties may be challenged or impugned; remote operations and the availability of adequate infrastructure; labour and employment matters; government regulation and approvals; the need for additional financing and that the Company may not be able to raise additional funds when necessary; the dangers inherent in exploration, development and mining activities; reliance on key personnel; competition; dilution; acquisition risks, such as the Company not being able to meet future payment obligations of its option agreements; changes in project parameters as plans continue to be refined; variations in ore grade and recovery rates; conflicts of interests; insurance and the risk of an uninsurable or uninsured loss; equipment material and skilled technical workers; risks and uncertainties relating to the interpretation of exploration results; cost estimates and the potential for unexpected costs and expenses; the Company may lose or abandon its property interests; the potential for delays in exploration or development activities, including the completion of geologic reports or studies; the uncertainty of profitability based upon the Company’s history of losses; conflicts with small-scale miners; failures of information systems or information security threats; the ability to obtain and maintain any necessary permits, consents or authorizations required for mining and exploration activities; the reliance upon contractors and third parties; use of and reliance on experts outside Canada; risks associated with internal control over financial reporting; compliance with complex regulations associated with mining and exploration activities; risks related to current global financial conditions; risks relating to international operations (including legislative, political, social, or economic developments in the jurisdictions in which Sierra Madre operates); the impact of viruses and diseases on the Company’s ability to operate; the volatility of Sierra Madre’s common share price and trading volume, and other risks pertaining to the mining and exploration industry as well as those factors discussed in the section entitled “Risk Factors” in Sierra Madre’s Annual and Quarterly Reports and associated financial statements, Management Information Circulars and other disclosure documents filed with Canadian securities regulators. Visit www.sedar.com to review these important disclosure documents under Sierra Madre’s issuer profile.

Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

There is no certainty the discussed targets will be reached nor that the proposed operations will be economically viable. Forward-looking information contained in this report or incorporated by reference are made as of the date of this report (November 7, 2021) or as of the date of the documents incorporated by reference, as the case may be, and Pinnacle Digest does not undertake to update any such forward-looking information, except in accordance with applicable securities laws. Accordingly, readers are cautioned not to place undue reliance on forward-looking information.

We Are Not Financial Advisors: This report does not constitute an offer to sell or a solicitation of an offer to buy Sierra Madre’s securities. Be advised, Maximus Strategic Consulting Inc., PinnacleDigest.com and its employees/consultants are not a registered broker-dealer or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

PinnacleDigest.com is an online financial newsletter owned by Maximus Strategic Consulting Inc. We are focused on researching and marketing for small public companies. This report is intended for informational and entertainment purposes only. The author of this report and its publishers bear no liability for losses and/or damages arising from the use of this report.

Never, ever, make an investment based solely on what you read in an online newsletter, including Pinnacle Digest’s online newsletter, or Internet bulletin board, especially if the investment involves a small, thinly-traded company that isn’t well known.

We Are Biased: Sierra Madre is a client of ours (details in this disclaimer on our compensation). We also own shares of the Company. For those reasons, we want to remind you that we are biased when it comes to Sierra Madre.

Because Sierra Madre has paid us CAD$125,000 plus GST for our online advertising and marketing services, and since we own shares of the Company, you must recognize the inherent conflict of interest involved that may influence our perspective on the Company; this is one reason why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before considering investing in Sierra Madre. Investigate and fully understand all risks before investing.

PinnacleDigest.com is often paid editorial fees for its writing and the dissemination of material. The clients (including Sierra Madre) represented by PinnacleDigest.com are typically junior companies that pose a much higher risk to investors than established companies. When investing in speculative stocks such as Sierra Madre it is possible to lose your entire investment over time or even quickly.

Set forth below is our disclosure of compensation received from Sierra Madre and details of our stock ownership in the Company as of November 7, 2021:

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, has been paid CAD$125,000 plus GST to provide online advertisement coverage for Sierra Madre for six months. Sierra Madre paid for this coverage. The coverage includes, but is not limited to, the creation and distribution of reports authored by PinnacleDigest.com about Sierra Madre (reports such as this one), as well as display advertisements and news distribution about the Company on our website and in our newsletter. We own shares of Sierra Madre. We intend to sell every share we own of Sierra Madre for our own profit. All shares Maximus Strategic Consulting Inc. currently owns or may purchase in the future of Sierra Madre will be sold without notice to PinnacleDigest.com’s subscribers or the general public. Maximus Strategic Consulting Inc. benefits from price and trading volume increases in Sierra Madre, and is therefore extremely biased when it comes to the Company.

Junior companies such as Sierra Madre are very risky investments: Sierra Madre is not an appropriate investment for most investors as it is highly speculative. Risks and uncertainties respecting mineral exploration and development companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this report. Visit www.sedar.com to review important disclosure documents for Sierra Madre.

Sierra Madre poses a much higher risk to investors than established companies. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time or even quickly. It is highly probable that Sierra Madre will need to raise additional capital in the future to fund its operations, resulting in significant dilution to its shareholders.

Sierra Madre may never take any project into production. Even if Sierra Madre is able to achieve commercial production, there is no certainty the Company will generate a profit. Furthermore, past historical and/or current production in the region of Sierra Madre’s projects is not indicative of future production potential for the Company. Any comparisons to other companies or projects may not be valid or come into effect. Mineralization on nearby projects is not necessarily indicative of mineralization on Sierra Madre’s projects.

Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are the particular attributes of a deposit, such as its size and grade, proximity to infrastructure, financing costs and government regulations, including regulations relating to prices, taxes and royalties, infrastructures, land use, importing and exporting, and environmental protection. The effect of these factors cannot be accurately predicted, but the combination of these factors may result in the Company not receiving an adequate return on capital.

While discovery of a mine can lead to substantial rewards, few properties which are explored are ultimately developed into producing mines. It is impossible to ensure that the current or proposed exploration and development programs on the Company’s projects will result in a profitable commercial mining operation.

Cautionary Note Concerning Estimates of Mineral Resources: This report may reference the terms “Measured”, “Indicated” and “Inferred” Resources. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of ‘‘Inferred Resources’’ exist, are economically or legally mineable or will ever be upgraded to a higher category, such as Measured and Indicated categories through further drilling, or into Mineral Reserves, once economic considerations are applied. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies. Readers are cautioned not to assume that all or any part of Measured or Indicated Mineral Resources will ever be converted into Mineral Reserves. Mineral Resource Estimates do not account for mineability, selectivity, mining loss and dilution. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Tepic Project Historical Mineral Resources: The Company cautions that an independent Qualified Person (“QP”), as defined in National Instrument 43-101 (“NI 43-101”), has not yet completed sufficient work on behalf of Sierra Madre to classify the historic estimate referenced in this report as a current Measured, Indicated or Inferred Mineral Resource, and Sierra Madre is not treating the historical estimate as a current Mineral Resource. Sierra Madre will need to validate previous work to produce a mineral resource that is current for CIM purposes.

While the information contained in this report has been prepared in good faith, neither Maximus Strategic Consulting Inc. nor Pinnacle Digest, give, have given or have authority to give, any representations or warranties (express or implied) as to, or in relation to, the accuracy, reliability or completeness of the information in this report (all such information being referred to as “Information”) and liability therefore is expressly disclaimed to the fullest extent permitted by law. Accordingly, neither Maximus Strategic Consulting Inc., nor any of its shareholders, directors, officers, agents, employees or advisers take any responsibility for, or will accept any liability whether direct or indirect, express or implied, contractual, tortious, statutory or otherwise, in respect of, the accuracy or completeness of the Information or for any of the opinions contained in this report or for any errors, omissions or misstatements or for any loss, howsoever arising, from the use of this report.

PinnacleDigest.com’s past performance is not indicative of future results and should not be used as a reason to purchase any security mentioned in this report or on our website.

The past success of members of Sierra Madre’s management team, board of directors, and advisory team are not indicative of future results for the Company.

The statements and opinions expressed by Pinnacle Digest are solely those of Pinnacle Digest and not the opinions of Sierra Madre. The statements and opinions expressed by Sierra Madre are solely those of the Company and not the opinions of Pinnacle Digest.

Maximus Strategic Consulting Inc. and PinnacleDigest.com (including its employees and consultants) are not chartered business valuators; the methods used by business valuators often cannot justify the trading price for most junior stock exchange listed companies, including Sierra Madre.

Unless otherwise indicated, the market and industry data contained in this report is based upon information from industry and other publications and the knowledge of Pinnacle Digest and Sierra Madre. While Pinnacle Digest believes this data is reliable, market and industry data is subject to variations and cannot be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process, and other limitations and uncertainties inherent in any statistical survey. Pinnacle Digest has not independently verified any of the data from third-party sources referred to in this report or ascertained the underlying assumptions relied upon by such sources.

Any decision to purchase or sell as a result of the opinions expressed in this report OR ON PinnacleDigest.com will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. We do not guarantee that any of the companies mentioned in this report (specifically Sierra Madre) will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, does not undertake any obligation to publicly update or revise any statements made in this report.

Learn how to protect yourself and become a more informed investor at www.investright.org

Trading in the securities of Sierra Madre Gold and Silver Ltd. is highly speculative.

To get an up to date account on any changes to our disclosure for Sierra Madre Gold and Silver Ltd. (which will change over time) view our full disclosure at the url listed here: https://www.pinnacledigest.com/disclosure-compensation/.