The markets are rattled, and investors are impatiently waiting to see if Trump and China can play nice via a trade agreement or risk potential destabilization.

The crumbling of the Turkish lira, further exasperated by the Trump Administration upping sanctions on the country, has ignited contagion fears around the world; but the greater issue is, and will continue to be, China-US relations. We wrote about this geopolitical issue a month ago in our report This is the Most Important Summer in a Decade. And today, we’re providing an update, shedding light on the potential global impacts of events over the past few weeks.

World Waits for Trade Agreement Between U.S. and China

In our report from July 14th, we wrote:

“Trump has painted himself into a corner on these tariffs, and the world’s sovereign wealth funds would rather not wait around to see who blinks first. Certainly, the exodus of cash via the Smart Money Flow Index is proof of this.”

Click here to read This is the Most Important Summer in a Decade.

Bad debt and worries the U.S. and China will not settle their intensifying trade war are sparking currency and commodity selloffs from the Euro Zone to South Africa. What currency or asset class is going up? Where was the smart money positioned in anticipation of such turmoil?

The U.S. dollar.

A crowded trade? Perhaps. But just like in 2008, in a sea of lesser options the greenback is the first choice for many. Not gold. Not the Chinese renminbi.

As all major U.S. indices, oil and basically everything was sold off early last week, the U.S. dollar index was up substantially. It closed at 96.32 – up 1.2% on Monday. It was up again Tuesday, rising 0.4% to 96.73, an incredible two-day swing for the world’s leading reserve currency. Finally, the currency stopped its climb shortly after (perhaps not coincidentally) Qatar essentially committed to providing a backstop for Turkey’s economy on Wednesday, followed by Germany Thursday and China on Friday. Nevertheless, The U.S. dollar index is now hovering around its highest level in over a year.

As tensions rise around Trump’s trade war, the U.S. dollar is strengthening, despite a risk for America of weakening (or outright losing) relations with key allies.

The takeaway from the recent bout of uncertainty is that ‘King Dollar’ still reigns supreme in times of uncertainty regarding the global economy.

It’s Still Vital to be Diversified

Despite recent strength from the USD, one must be cognizant of the fact that it does not help the US economy, particularly when the country is in trade disputes with more than half the world economy. And it’s no secret Trump is not a fan of a ‘strong dollar’ – he said as much last April, when the USD index was slightly higher than today.

As investors, staying diversified should be the ultimate goal; be it through currency diversification, real estate, precious metals and stocks. And it’s worth noting that only a fractional portion of one’s wealth should be in speculative issuers on the TSX Venture.

For Canadians, the prime opportunity for currency diversification (in USD) has long since passed. Most of us know a smart uncle or business associate who bought a ton of USD when the loonie reached parity (even a little higher) back in 2011. With oil still below $70 per barrel and the Liberals running huge deficits, our chances of a strong loonie are non-existent in the near-term.

Key to remember that currencies, like commodities, move in cycles. Even the greenback, while historically more valuable than the majority of global currencies, is not static. And it is no stranger to wild swings (see 1 year chart above). It trends lower when global economic activity is humming, and higher when people are uncertain of the global economy’s future.

Let’s take a look at some currency carnage to remind ourselves why storing wealth across a number of *strong currencies (led by fiscally responsible governments) is so important.

*There are many ways to play the currency market aside from forex trading. ETFs provide great options.

Turkey – A Lira in Distress

On Monday, August 13th, the lira hit a record low of 7.2362 to every U.S. dollar – down almost 10% on the day! After Turkey’s central bank pledged to provide liquidity, the lira jumped more than 6% Tuesday. Still, after scandals and turmoil, the Turkish lira has been crushed more than 40% this year.

India Rupee Hits Record Low Against USD

Wednesday also saw the Indian rupee hit a record low of 70.33 against the dollar. The rupee has been crushed by the dollar since the financial crisis of 2008, but its decline has accelerated since Trump accused India of charging “…as much as 100 per cent tariff” in June.

USD to Rupee – 10 Year Chart

chart source: XE.com

Hyperinflation Fears Continue to Haunt Argentina

Reuters reported Monday that, “Argentina increased its benchmark interest rate to 45 percent from 40 percent, the central bank said on Monday, after the peso currency tumbled in response to a local corruption scandal and Turkey’s currency crisis.”

While we can’t begin to imagine inflation so high that 45% interest rates are warranted, this is reality in Argentina. In 2017, Argentina was the third richest country in South America, and is home to a relatively educated population.

USD to Argentine Peso – 2 Year Chart

chart source: XE.com

Trump | The Great Disruptor

While the above governments and currencies have seen their share of turmoil, the main event is the evolving trade war with China. In classic Trump fashion, he is not flinching, waiting for China to blink, despite both sides desperately needing a deal.

In our July 14th Weekly Volume This is the Most Important Summer in a Decade, Trump’s willingness to push China to the brink is explained:

“As Trump wages a global trade war, in a bid to balance U.S. trade deficits, established sectors and trading relationships are under fire. As we have documented, the U.S. is in the best position to fight a global trade war and appears prepared to do so…”

Access to the world’s largest economy is a must have in today’s globalized world. If you don’t have it, and with the blessing of Trump, your currency and economy will suffer. China’s economy cannot expand without America, and, to a degree, vice versa. While both countries have begun implementing tariffs on each other, the most significant deadline is at the end of August. We are now just twelve days from the Trump Administration’s August 30th deadline on $200 billion worth of tariffs for Chinese goods…

Last week we saw there was a chance at progress in trade talks between China and the US…

It was reported by Bloomberg on Thursday,

“The Chinese delegation led by Wang will meet with an American group led by Malpass at the invitation of the U.S., China’s Ministry of Commerce said in a statement on its website Thursday. It will be fourth round of formal talks since trade tensions flared this year, but the first session since early June.

“This will be ‘talks about trade talks,'” said Gai Xinzhe, an analyst at the Bank of China’s Institute of International Finance in Beijing. “Lower-level officials will meet and haggle and see if there is a possibility for higher-level talks.”

Problem is, there likely isn’t enough time to get a deal done before the August 30th deadline. That said, there are three potential outcomes as we see it:

- The US and China miraculously pull off a deal in time, in which case the markets will go on a run this fall.

- The US and China do not come to a deal and further tariffs are implemented, which would lead to a market correction of significance.

- Or, and this is what we deem the most likely, the US and China communicate to the world that they are working on a deal, making progress, but still have some details to iron out. In this case, the volatility in the market will abate and we will be in for a rather mediocre, but safe, September.

U.S. and China Need Trade Agreement to Bolster Sentiment

The reason we see the latter as the likely scenario is because both Trump and China need some good news on the home front. Trump has the midterm elections, and the House is in question for Republicans.

China is facing serious domestic economic headwinds, stunting its rise to a world economic power near equal to America, while the U.S. economy booms (Q2 US GDP was an impressive 4.1%). There is also social unrest mounting in China which we will get to shortly.

Curtis Chin, an Asia fellow at the Milken Institute, stated recently,

“We have to realize that perhaps China isn’t as strong as when we at first think. China is still figuring out also how to deal with this trade situation, how to ensure the stability of its domestic economy.”

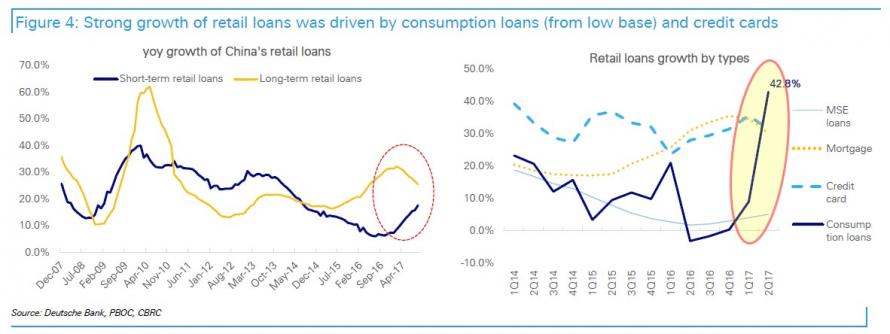

China has two very serious issues facing its economy, not including the validity of its GDP numbers which have stagnated. First of all, Chinese household debt is up over 40% in the past year, despite credit growth across other debt categories remaining stable.

Below: Note the purple consumption loans skyrocketing towards the bottom right.

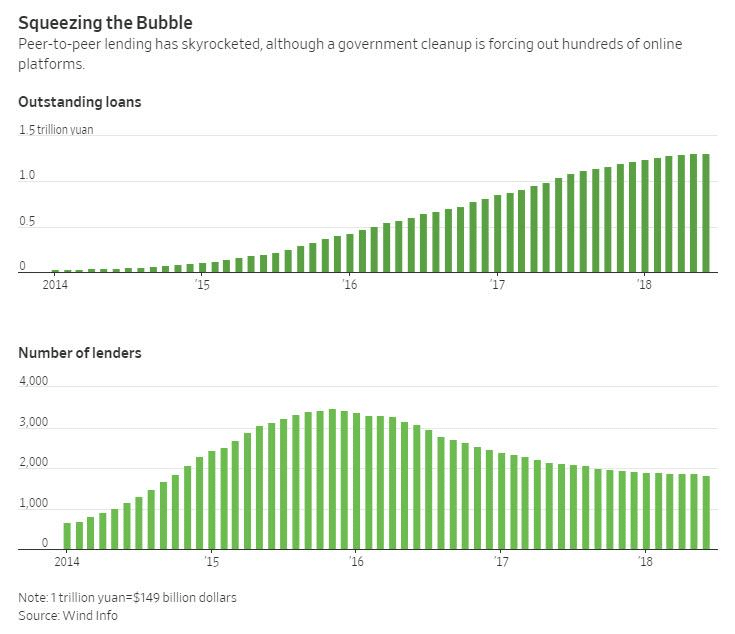

The second internal issue facing China, and perhaps most concerning, is the explosion in peer-to-peer lending.

Bank runs on various peer-2-peer lenders have created social unrest in recent weeks…

Zero Hedge reported on the potential calamity,

“We pointed out that outstanding loans on P2P platforms rose 50% just last year to total Rmb1.49 trillion ($215 billion) – making the size of China’s P2P industry far bigger than in the rest of the world combined – and due to their lack of collateral, interest rates often are as high as 37%, with additional charges for late payment.”

Outstanding Loans on Peer-to-Peer Lending Skyrockets

With household debt soaring and many of its citizens opting for risky peer-to-peer platforms for credit, China may be in the final stages of its transformational growth period that began in the 1980s. The Shanghai Index is down over 20% on the year; and with the renminbi falling, the Chinese people are losing purchasing power.

Meanwhile, in the U.S., the dollar is strengthening against its peers (in part because of Trump’s trade policy), while GDP is running at the fastest annualized pace in 13 years.

US dollar to Chinese yuan exchange rate is nearing its highest level in many years as the renminbi is crushed against a rising USD. It last stood around 6.88.

US Dollar to Chinese Yuan Exchange Rate – 1 Year Chart

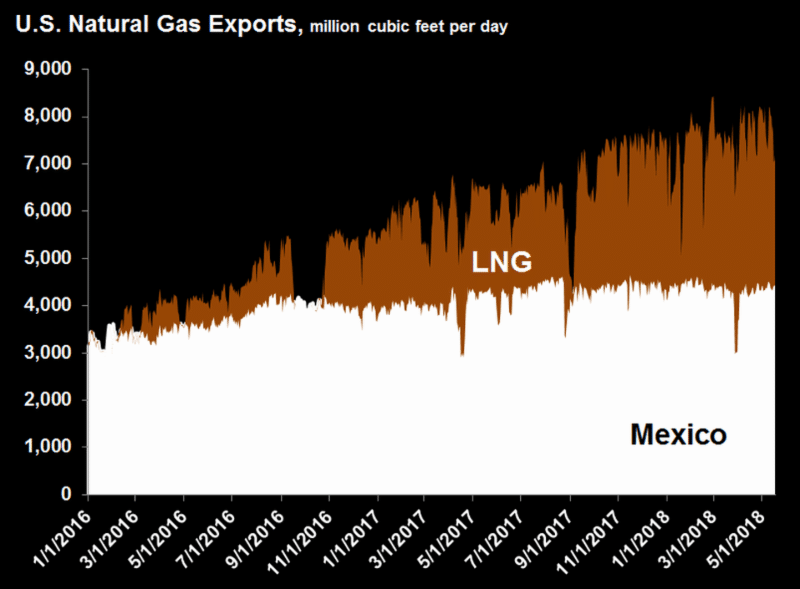

President Xi Brings out the Big Guns with LNG

In a recent article titled China depletes its ammunition belt with latest tariff threat, China President Xi’s retaliatory strategy to curb American LNG imports is explained. Recently, the Chinese included American liquefied natural gas in the top tier for an additional 25% of duties. For them, it could be a good play even if just a bargaining tool. LNG exports are near and dear to Donald Trump’s heart as 20% of the $250 billion in deals signed during Trump’s visit to Beijing last November consist of natural gas.

Part of Trump’s energy plan is to make the U.S. the largest exporter of crude and natural gas in the world. U.S. oil production is at record levels, with exports topping 3 million per day, just behind Saudi Arabia. Most economists expect the U.S. to surpass the Saudis by year end.

In Thank Goodness For U.S. Natural Gas Exports, Forbes contributor Jude Clemente, explains,

“Exports are an engine of growth: they generate huge income, cut our trade deficit (measured at a mind-boggling $566 billion in 2017), and diversify markets.

I have us at 10 Bcf/d of LNG exports in 2020.”

*Note the steady rise in natural gas exports since Trump took office and key terminals came online.

Wrapping Up

Trump is achieving his goal of disrupting the status quo. However, it is far too early to tell if the long-term effects will benefit the United States. Some are arguing his trade war policies could turn inflationary before long. Others say the president is ruining historic alliances with America.

The Trump Administration, led by the self-proclaimed ‘King of Debt,’ is preparing to borrow money in a bid to lessen the blow to domestic producers hit by tariffs. According to Reuters,

“Farmers in the U.S. Midwest are expected to receive a $12 billion agricultural-aid package as a result of tariffs that are hitting soybean and other farmers. Walker and U.S. Senator Lisa Murkowski have argued that Alaska’s seafood industry also deserves aid.”

In U.S. deficit now projected to top $1 trillion starting next year The Wall Street Journal reminds investors that the “Trump administration expects the annual budget deficits to rise nearly $100 billion more than previously forecast in each of the next three years, pushing the federal deficit above $1 trillion starting next year.”

Trade Agreement with China: Pivotal to Global Prosperity

While investors focus on the latest jobs numbers or GDP, the cost of such growth appears to be overlooked. The strength of the U.S. dollar is dependent not only on the strength of the U.S. economy, but the dependence of other economies on it. This is one reason why Trump’s potentially dangerous trade negotiation strategy of disrupting all at once is concerning. Instead of renegotiating one key trade deal at a time (NAFTA, Eurozone, China, Turkey etc.), he risks alienating America by trying to do them all at once. What’s more, if the U.S. economy ever enters recession, Americans are going to be left with one heck of a debt hangover, and there will be an opening for a new economic power, or at least a sharing of the top spot. For all these reasons, Trump needs a trade agreement with China more than ever.

Maya MacGuineas, president of the Committee for a Responsible Federal Budget, which supports debt reduction, was recently quoted in WSJ,

“[President Trump] used to talk about creating such great economic growth to reduce the deficit, now you see a budget acknowledging a massive run-up due to policies he has supported.”

All the best with your investments,

PINNACLEDIGEST.COM

P.S. If you’re not already a member of our newsletter and you invest in TSX Venture stocks, what are you waiting for? Subscribe today. Only our best content will land in your inbox.