Countries governed by capitalist democracies that can produce, use and export cheap energy are rich. Plain and simple. In The Accidental Superpower by Peter Zeihan, a fantastic book we recommend picking up, this principle is explored in great detail. Moreover, it explains the underlying reasons the United States is the sole superpower today. It is our belief that U.S. oil reserves, production and export capabilities, and regulatory policy will ensure it remains a superpower for the rest of our lives. The Canadian energy sector is suffering dearly at the hands of the United States and the Trump Administration.

While renewables and EVs are on the rise, understand that in 2018, oil, aside from potable water, is still the world’s most essential and consumed commodity. Economies with abundant oil reserves, capable of relatively cheap production and with the required export infrastructure in place, will be very wealthy for the next 50 years – at least.

Oil has a myriad of uses, so much that a developed country cannot function without it. Hence, the distinct advantage cheap oil gives a nation over its trading partners.

President Trump understands this; therefore, his administration has taken every measure to ensure the U.S. beats out all of its competitors, including Canada. A foundational principle to Trump’s economic agenda revolves around the promotion of drilling for oil and gas.

Canadian Energy Sector Declines Amidst Trump Presidency

If energy hegemony is the goal, the U.S. has done everything right in the past ten years, while the Canadian energy sector has been entangled with inter-provincial squabbles and constant redefining of pipeline regulations.

In Canada, politicians continue to argue amongst themselves while environmentalists and scientific studies stall any chance of our oil even entering the export game. Regrettably, for Canadian energy investors, time is up. It is amazing how the power has shifted in just the past ten years.

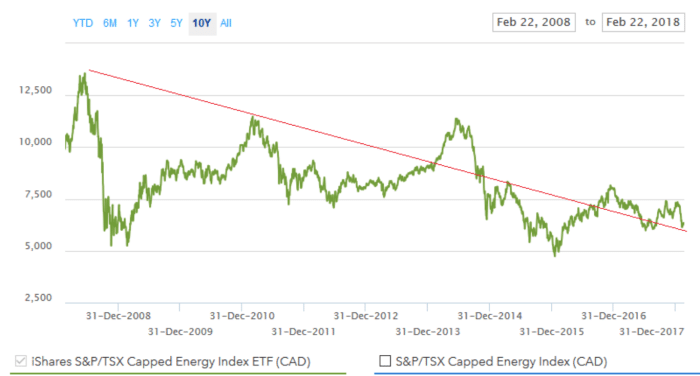

BlackRock’s iShares S&P/TSX Capped Energy Index ETF, which consists of Canada’s largest energy players, is down roughly 9.95% year to date. That is after losing 11.1% in 2017. Bear in mind, oil is up nearly 40% since June 2017…

Note: While the ETF gained 38% in 2016, it was rebounding from a 24% decline in 2015 and a 16% decline in 2014. It has erased all of its gains and is down roughly 20% over the past 4 years.

Negative return of a hypothetical $10,000 investment in Candian Energy ETF shown below (10 year):

Consider this, in a late 2016 article titled Canada oil sands Asia export dream faces port bottleneck, the crux of Canada’s issue comes into focus:

“Currently, some 98 percent of Canadian crude exports reach the United States, where it sells at a discount to world prices. Vancouver is the only west coast port where it can be sold on to Asia.”

The article is referring to the Trans Mountain Pipeline System, which has been operating since 1953.

According to Kinder Morgan, “It is the only pipeline system in North America that transports both crude oil and refined products to the west coast.”

Canadian Energy Forced to Take U.S. Prices

Sandy Fielden, director of oil and products research at Morningstar, stated last year that,

“If Canada can’t get their oil to another market besides the U.S. (market), you’ll always be a price taker, not a price maker.”

Canada has failed, time and again, to expedite the approval process of an oil pipeline to its west coast.

Meanwhile, south of the border, pipeline companies are busy counting their profits. On Wednesday, February 21st, Energy Transfer Partners LP, one of the largest oil and gas pipeline companies, which controls 70,000 miles of pipeline, reported more than a quadruple in net income to $2.5 billion last year. Energy companies throughout the U.S. have entered a ‘golden age’ amidst low taxes and the new ability to export.

The one-two punch of Trump’s Dakota Access Approval (where he promptly sent in the military to ensure access and immediate completion) and the U.S. tax overhaul, has  America’s oil sector in a euphoric frenzy. An oil-friendly President, combined with the rise of U.S. shale, has America firmly on top of the energy world.

America’s oil sector in a euphoric frenzy. An oil-friendly President, combined with the rise of U.S. shale, has America firmly on top of the energy world.

U.S. Dominates Canadian Energy Sector in Every Way

Martin Fraenkel, president at S&P Global Platts told CNBC in January that,

“The U.S. is emerging as, not only a military and economic superpower, but as an energy superpower.”

Furthermore,

“We are expecting that by 2020, the U.S. is going to be one of the top 10 oil exporters in the world.”

On February 22nd, Bloomberg published an article titled U.S. Oil Boom Tempts Saudis to Consider American Crude Sale.

In an unprecedented move, the Saudis are asking potential buyers in Asia if they are interested in U.S. supply, according to officials at two regional refiners. That’s right. The U.S. is now exporting significant amounts of crude oil, and the Saudis may want in on the action!

LOOP is a big development for US energy dominance

If the U.S. were to execute a sale and begin exporting oil to the Saudis for distribution to China and Asia, it would be a game changer for OPEC and the global oil market. It would be an historic geopolitical event. Keep an eye on this developing storyline.

In January, CNN Money released an article titled America could become oil king of the world in 2018. It read,

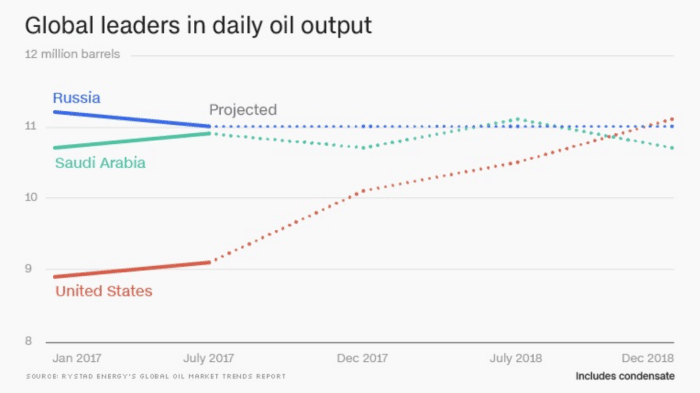

“The United States is poised to ramp up crude oil production by 10% in 2018 to about 11 million barrels per day, according to research firm Rystad Energy.”

Is it any wonder Canadian oil companies are reeling?

According to Natural Resources Canada, 99% of Canada’s oil exports go to the U.S. Should Canada be worried that the U.S. is becoming the world’s largest oil producer, and is on track to be a top ten exporter? Absolutely.

Ten years ago the U.S. was desperate for Canadian energy. Today, it can take it or leave it; which is why, in part, Canadian oil sells for a deep discount to WTI – nearly 40% cheaper, in fact.

U.S. Shale Oil to Threaten Russia and Saudi Arabia

Increased shale oil output is allowing the U.S. to threaten both Russia and Saudi Arabia as the planet’s leading crude oil producer. The U.S. has not led the world in oil production since 1975. However, that will likely change by the end of the year…

US Field Production of Crude Oil:

Rystand Energy is predicting the U.S. to outpace Russia and the Saudis in oil production by the end of the year. It barely took one year for America to increase its oil production from 9 million to 10 million barrels per day.

As daily oil output climbs, unlike Canada, the U.S. has the infrastructure in place to export globally:

On February 19th, S&P Global Platts reported,

“LOOP LLC confirmed that it successfully completed the first VLCC crude oil loading operation at its Deepwater Port, 18 miles offshore of Port Fourchon in Louisiana.”

Exports from LOOP, which stands for Louisiana Offshore Oil Port, matters for a few key reasons. S&P Global Platts explains,

“The appeal for US crude oil is poised to broaden as the freight costs for VLCCs are much lower than smaller tankers and this could spur more global demand for US crude, making it viable for more arbitrage opportunities.”

Increasing U.S. exports is a major development that needs to be watched closely by Canadian energy investors. Also, it may help reverse a trend of multi-billion dollar monthly trade deficits for America. Imagine oil at $80 to $90 per barrel by 2020, at a time when the U.S. becomes the world’s largest exporter…

Saudi Arabia expects to collect 480 billion riyals ($128 billion) from oil sales in 2017. So, if oil prices move up and the U.S. tops Saudi Arabia in production, the potential for significant gains is clearly there; and a Trump re-election would be likely (Rasmussen reported this past week that 50% of ‘Likely U.S. Voters’ approve of President Trump’s job performance).

Finally, regarding LOOP,

“The oil is stored in eight underground caverns leached out of a naturally occurring salt dome. The caverns are capable of storing approximately 60 million barrels of crude oil (a barrel of oil is equal to 42 U.S. gallons).”

Canada’s Non-Existent Infrastructure Leaves it in Last Place… Again

Meanwhile, in Canada, approval delays turn from months into years as the oil and gas export market share that was once up for grabs is now dust in the wind.

Just like natural gas, Canada has let its export potential in the oil sector fade to black. Indecision, brewing inter provincial trade wars, environmental activism and political squabbling have caused pipeline delays (which makes Canada amongst the worst investment climates for energy players in the developed world) and cost Canada dearly. Scotiabank figures the pipeline backlogs could cost the Canadian economy $15.6 billion annually.

“Pipeline approval delays have imposed clear, demonstrable and substantial economic costs on the Canadian economy,” according to bank chief economist Jean-Francois Perrault.

We Began Warning About Challenges Facing Canada’s Energy Sector in 2013

None of this is news to our subscribers. We warned as early as 2013 the race to export natural gas was on. For years we have put out story after story, depicting Canada’s indecision and the dire long-term consequences for the Canadian energy industry. The results show up in the poor Canadian oil ETF performance highlighted above. It’s down during a period when the rest of the sector, on a global level, is up.

In November, rumours swirled that Calgary-based TransCanada Corp., a staple of Canada’s energy industry, may be seeking to remove ‘Canada’ from its name altogether. The company diversified hugely into the U.S. last year with its $10.2 billion Columbia Pipeline Group Inc. acquisition. Enbridge and Encana are two more examples of a Canadian pipeline company and producer focusing on US exports and production.

After Enbridge’s failed attempt at a west coast pipeline and terminal, it is turning its attention south…

Enbridge’s Line 3 Replacement Program runs 1,660 km from Alberta to near Duluth, Minnesota. The line is expected to cost C$5.3 billion on the Canadian side and US$2.9 billion for the U.S. portion. It is expected to be in-service by 2019.

Without more western refineries or an export terminal, Canadian energy will forever be beholden to America – a very bleak future indeed.

Canada’s Last Shot at a West Coast Pipeline: Trans Mountain Expansion

It has been painful to watch… Kinder Morgan is being made an example of as it faces yet another environmental obstacle from the British Columbia government. A proposal with new oil-spill regulations has temporarily blocked the Trans Mountain Expansion project, despite already receiving approval from Prime Minister Trudeau’s Liberals and the National Energy Board.

B.C.’s Environment Minister, appointed by the newly elected NDP-Green coalition government, said the province will establish a scientific advisory committee to determine if it is possible to clean up diluted bitumen after a spill in water effectively.

Cornerstone Investments wrote on Seeking Alpha earlier this month that,

“Should the committee determine there is no effective clean-up for bitumen dumped into waterways, the province would likely move to make the regulation permanent.”

The back and forth over this pipeline and other past failed bids has nearly sparked a trade war between Alberta (home to the world’s third largest oil reserve) and B.C. In retaliation to this recent pipeline stall tactic by B.C., Alberta is now refusing to import B.C. wines – symbolic of a fractured Canada.

While Canada airs its dirty laundry in an embarrassing inter-provincial catfight, energy powers are rising elsewhere…

The U.S., Australia and Russia have matured into energy export powerhouses, building numerous LNG export terminals, while locking up multi-year contracts with Asian nations hungry for oil and natural gas.

We warned Canada was poised to lose its ability to export natural gas as early as May of 2013, in The Four Nat Gas Horsemen.

Moreover, in Destroying Canadian Energy from Within, we wrote,

“With the U.S., Russia and Australia having already built natural gas pipelines to LNG terminals ready to transport natural gas around the world, Canada’s race to be first to market is long over… in fact, there may not be much of an export market left for Canada if/when it finally gets prepared to ship LNG abroad…”

While Canadian environmentalists rejoice with anti-pipeline activists, the economy misses out. Although Canada is coming off strong quarters of GDP growth in 2017, what happens when it inevitably enters a recession and desperately needs energy exports?

U.S. Winning Battle Against Alberta Oil

Canadian researcher and writer, Vivian Krause exposed a paper trail of nefarious motives surrounding articles designed to filibuster Canada’s Energy East pipeline. The Energy East pipeline proposal was designed to carry heavy oil from Alberta to Saint John, New Brunswick. It failed to pass regulatory hurdles and the bid was abandoned.

The suspension of the National Energy Board’s review of the Energy East pipeline can be traced back to anti-pipeline activism featured in a story by The National Observer.

According to a Financial Post article titled, Vivian Krause: The cash pipeline opposing Canadian oil pipelines,

“The Rockefeller Brothers Fund, a charitable foundation financed by the famous oil barons of the same name, has funded New Venture explicitly “to support the campaign to cap tar sands production in Alberta.” When Rachel Notley’s NDP government announced a climate plan in November that would cap the Alberta oil industry’s allowable carbon emissions at 100 million tonnes, the Rockefellers got exactly what their funding was meant for…”

She also wrote,

“Last year, the U.S. began exporting oil to China, Japan, France, Italy and elsewhere but there is no campaign against exporting U.S. oil.

The Tar Sands Campaign is keeping Canadian oil landlocked within North America, stopping it from reaching overseas buyers and allowing the U.S. to dominate the market. Anti-pipeline activism claims to be about the carbon emissions and the climate but what it amounts to is economic protectionism.”

Final Thoughts on Canadian Energy Sector

TransCanada, now investing billions into U.S. infrastructure, was the pipeline company who put forward the bid for that contentious pipeline. The same company, one of Canada’s largest with a more than $50 billion market cap, is rumoured to be considering dropping Canada from its name. If true, can you blame them?

Opponents to Alberta’s oil sands might say the articles are a conspiracy theory and that Canada’s ‘tar sands’ are harder to process, etc. However, when the Rockefeller Brothers Fund is paying cash to create opposition to a competitor of theirs, one has to wonder. Either way, Canada is in a bad spot when it comes to its energy sector, and potentially for its long-term economic growth. With minimal ability to refine in western Canada, and limited to no ability to export (except to the U.S., which refines most of Alberta’s oil), Canada doesn’t stand a chance at competing in the global oil market. At this point, all the Canadian energy sector can hope for is a few crumbs from the leftovers America leaves behind.

All the best with your investments,

PINNACLEDIGEST.COM

P.S. If you’re not already a member of our newsletter and you invest in TSX Venture stocks, what are you waiting for? Subscribe today. Only our best content will land in your inbox.