For well over a century, gold stocks have been one of the most popular investment assets among speculators in Canada. However, investing in gold stocks, particularly junior gold stocks, is not for the faint of heart. Extreme volatility is the norm, particularly among junior or small and micro-cap gold companies.

An important fact that’s sometimes overlooked is gold equities often drastically underperform the metal during bear markets or downturns for gold.

So, why do investors even bother with gold stocks?

Despite their inherent volatility, junior gold stocks offer incredible upside potential during gold bull markets.

Anecdotally, during a bull market for gold, senior gold miners typically outperform the metal by a multiple of 2 to 3 times. Junior gold stocks – while riskier by an order of magnitude – can outperform the precious metal’s return by 5 or even 10 times during a bull market. With this in mind, it’s little wonder why speculators with a higher risk tolerance often opt for junior gold stocks.

In our ‘Ultimate Guide to Investing in Junior Gold Stocks,’ we go over the typical lifecycle of these risky equities, some of the different types of gold deposits, and, on a high-level, how to interpret drill results.

So, buckle up… with gold back in its secular bull market after roughly five years of consolidation between 2013 and 2018, now may be a good time to learn about junior gold stocks.

Why Invest in Junior Gold Stocks?

The simple answer is: gold stocks tend to outperform gold bullion during bull markets. Of course, as with many speculative ventures, there is a caveat; while gold equities provide investors with more upside during bull markets, they also present more downside when gold declines.

Ed Coyne of Sprott Insights explains this principle in detail,

“Historically, rising (and falling) gold prices have a two- to three-times multiplier effect on gold stocks: If the value of gold bullion increases by 10%, mining stocks tend to increase by 20-30%, and vice versa. The reason: Miners have significant fixed operating costs and high operating leverage, meaning big swings in physical gold prices have a larger impact on miners’ profitability.”

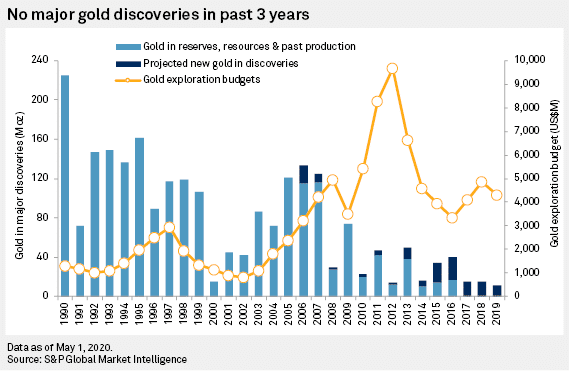

One of our main interests in gold stocks comes down to the limited number of new gold discoveries in recent years. Check out the below chart from May of 2020:

It’s a well-documented fact that economically mineable gold reserves have been in decline over the past decade. This makes gold companies that manage to make an economic discovery all the more attractive.

How Do You Invest in Junior Gold Stocks?

The real challenge is finding a junior gold stock with a high-quality project, exploration upside potential, and, of course, a strong management team. After all, the road to production is a long one, and as we wrote previously about mining stocks,

“In the mineral exploration business, 1 out of every 1,000 prospective mines eventually reaches production. What happens to individual stocks along the way, through cycles of boom and bust, is dominated by speculators, drill programs, commodity prices, and management’s decision making – complete variables.”

Start with a Strong Management Team

Many of the top-performing CEOs in the world find success on more than one occassion during their careers — think Bezos, Musk, Robert Friedland, etc.

While past success is never a guarantee of future success, when conducting due diligence on junior gold stocks, we like to start with the management team. We often look for companies with leaders who have experience in taking projects to production and/or have had a previous buyout of one of their mineral projects…

Right from the start, this gives us a level of confidence that an unproven management team simply cannot provide. We’ve written about this in the past — the most recent example being “Leading Juniors to Multimillion-Dollar Buyouts (2019-2020 Edition)”.

Drill Baby, Drill

There is an old adage in the mineral exploration business — drills can be a terrible truth machine, and nothing pays like discovery. Successful drilling depends on the grade and depth found in the core.

When evaluating junior gold stocks, nothing outside of management is more important than the quality of the project(s). Frequently, a junior will explore an old mine or a prospective claim block that has returned high grab samples or has had some positive drill results in the past.

Said junior would need to raise money (typically through a private placement/equity offering) to expand its exploration program through various site survey methods, mapping, grab samples, trenching, and the all-important drilling.

Keep in mind that private placements create shareholder dilution. Dilution can be a silent value-killer that prevents many stocks from rising even after making a discovery. If a company issues too many shares in a bid to finance seemingly never-ending exploration or development programs, its odds of being a positive investment decline markedly.

Now, back to drilling…

The Basics of Interpreting Gold Drill Results?

Junior gold stocks can increase substantially based on exceptional drill results. So, what do great drill results look like?

UndervaluedEquity.com defines low, medium, and high-grade drill results for gold below:

| Low Grade | less than 1.5 g/t |

| Medium Grade | 1.5 g/t – 5 g/t |

| High Grade | over 5 g/t |

But the grade of the drill results isn’t the only thing that matters…the length (or depth) of mineral continuity is essential as well. For example, 5 grams per tonne of gold over 2 metres won’t get too many people excited. However, if a junior returns 5 grams per tonne of gold over 30 metres, the market could react very positively, particularly if it is a new discovery drill hole. A new discovery with deep intercepts, combined with higher grades, often results in a flurry of speculation.

Once a junior gold company has created what we call ‘smoke’ (in other words, delivered promising drill results), the next exploration/development phase can begin…

While drilling is a critical part of the exploration process, it does not prove how much mineral content is actually in the ground. To get a better understanding of the potential mineral content in the ground, junior gold companies in Canada need to produce a National Instrument 43-101 or NI 43-101 Resource Estimate(s).

What is a National Instrument 43-101 (NI 43-101) Resource Estimate?

According to Wikipedia,

“National Instrument 43-101 (the “NI 43-101” or the “NI”) is a national instrument for the Standards of Disclosure for Mineral Projects within Canada. The [NI 43-101] is a codified set of rules and guidelines for reporting and displaying information related to mineral properties owned by, or explored by, companies which report these results on stock exchanges within Canada.”

Created after the Bre-X scandal (the inspiration for Matthew McConaughey’s 2016 movie, Gold), the NI 43-101 is designed to ensure no fraudulent information relating to mineral properties is ever published and promoted to investors.

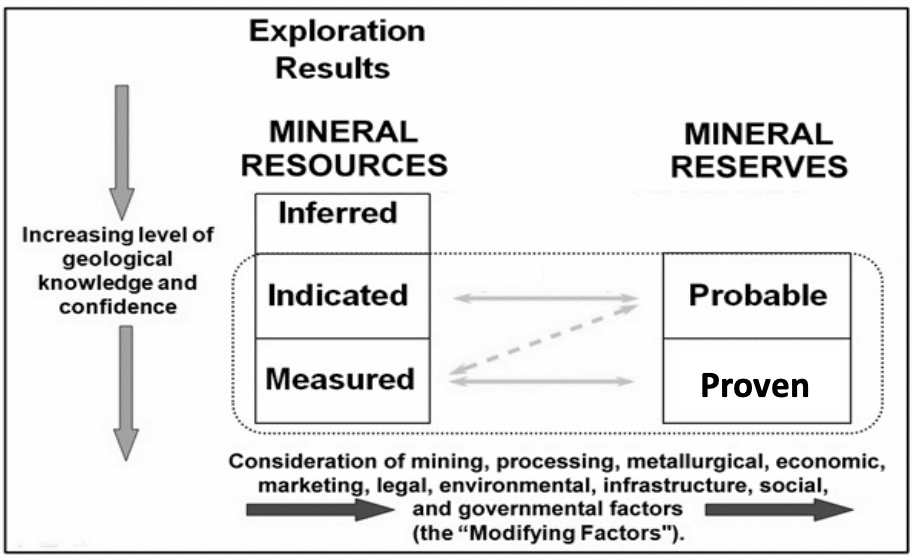

Now, included in the NI 43-101 Resource Estimate are mineral exploration reports detailing the resources (the categories of resources include, Inferred, Indicated and Measured). However, even with a NI 43-101 Resource Estimate, a project still has a long way to go. Following the completion of an NI 43-101 Resource Estimate, if positive, the junior gold company will likely proceed to complete a Preliminary Economic Assessment (PEA) to move the project another step closer to a production decision. Remember, exploration work is intended to help determine whether or not a project has the potential to be economically viable.

What is a Preliminary Economic Assessment (PEA)?

William Hughes of Crux Investor elaborates:

“PEAs include estimates of the capital costs required to bring a project into production, operating cost, and cash flow. They also include mine plans and processing and production plans. PEAs are preliminary studies and often based on inferred resource estimates made with limited data. They are not suitable for economic decision making or reserve reporting.”

Following an NI 43-101 Resource Estimate and PEA, the next potential project milestone is a Feasibility Study.

What is a Feasibility Study?

There are three kinds of feasibility studies: a preliminary feasibility study (PFS), a definitive feasibility study (DFS), and a bankable feasibility study (BFS).

Let’s begin with the PFS, theoretically a more detailed and confident version of the PEA. In the same William Hughes article on Crux Investor, he writes that,

“They [preliminary feasibility studies] also include plans to mitigate potential impacts to the project, such as geographic or community obstacles, permitting issues or logistical challenges. After completing a PFS, a company will know if they should move forward with permitting or re-evaluate the project.”

After preliminary feasibility studies, definitive feasibility studies ultimately are designed to further evaluate if the project can be an economic success. Finally, we have the bankable feasibility study. If the goal is production, financiers often need to see this before any debt-financing or credit facility is established for the asset.

All of these reports and studies take time and money (years and tens of millions of dollars invested in the project).

It is important to note that all of the aforementioned studies and estimates must be conducted by a third party to the company in order to avoid conflicts of interest.

What is the Difference Between Mineral Resources and Mineral Reserves?

Mineral Resources and Mineral Reserves are vital concepts for investors to understand as they form the basis for a project’s future potential viability. In simplest terms, the difference between Mineral Resources and Mineral Reserves is their level of geological confidence; for example, an Inferred Mineral Resource is the lowest level of confidence while a Proven Mineral Reserve is the highest level of confidence that the stated mineral content is actually in the ground (there’s a lot more to it, but this is just a high-level overview). There are 3 categories of Mineral Resources: Inferred, Indicated and Measured — in order of ascending geological confidence. Mineral Reserves go from Probable to Proven.

With all of this in mind, there are some critical factors investors should be aware of when it comes to Mineral Resource Estimates…

First, although terms like “Inferred”, “Indicated”, and “Measured” Resource Estimates are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize them. “Inferred Mineral Resources” have a significant amount of uncertainty as to their existence and as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to Measured and Indicated categories through further drilling or into Mineral Reserves once economic considerations are applied.

Moreover, under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies. Investors should not assume that all or any part of Measured or Indicated Mineral Resources will ever be converted into Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Mineral Resource Estimates do not account for mineability, selectivity, mining loss, and dilution. A Mineral Resources Estimate may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

The chart below from the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), maps out the relationship between Mineral Resources and Mineral Reserves:

For further research, check out the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines found here.

How Do You Assess the Value of a Junior Gold Stock?

First of all, it is important to understand that you’re not “value investing” when it comes to junior gold stocks (the ones which are not in production). You are SPECULATING!

However, when evaluating junior gold companies, it’s essential to keep in mind the comparables concept (commonly referred to as “comps”). Back in 2015, we wrote,

“You may think you have found one of the most undervalued junior miners to ever list on the stock market, but if you can’t find nearly identical comps, trading at higher valuations, there’s always a reason for its cheap share price.”

That whole article about the comparables concept could come in handy when trying to assess the fair “speculative value” of a junior gold stock.

Where Do Canadian Junior Gold Companies Operate?

Canadians are known as the world’s miners. From Namibia and Argentina to Indonesia and projects as far north as the Arctic circle, Canucks search for gold (and other minerals) around the globe. The vast majority of publicly traded junior gold companies can be found on the TSX Venture, Canada’s leading junior exchange for small and micro-cap companies.

Understanding jurisdiction as it relates to risk is a fundamental concept to grasp. A 5 million-ounce high-grade deposit in a rural part of a country with limited infrastructure or access, and a history of political instability, may not be as valuable as a 2 million-ounce project in Canada or the US that’s near major roads and power.

Environmental concerns can also kill a project. We don’t think it wise to make a large bet on a deposit or emerging asset near any protected species or rivers or anything that could upset the local community. Environmental stewardship is of paramount importance today, and its influence is only getting stronger.

No matter what, always remember that when buying junior gold stocks that are not in production, you are speculating and nothing more. These are gambles and there are many factors that can derail a seemingly perfect project.

Wrapping Up

If you’ve read this far, you realize investing in junior gold stocks can be a little bit like navigating a minefield. Although it can seem exciting during a gold bull market, it’s important to remember that risk is always prevalent in this space. In the world of finance, you can’t have tremendous upside potential without having similar downside risk.

We hope this report provides a high-level overview of junior gold stocks. It is not intended to be exhaustive. Always conduct your own thorough and independent due diligence to properly understand the risks associated with investing in speculative companies such as junior gold operations. A good place to start your due diligence is by reviewing the prospective company’s Sedar filings at www.sedar.com. Also remember that junior gold stocks are not suitable investments for most investors as it is possible to lose your entire investment over time or even quickly, given their speculative nature. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

At the end of the day, every junior gold company’s goal is to be bought out by a major or go into production. Special gold assets tend to be bought out long before a production decision is made. When it comes to investing and speculating in junior gold stocks, timing the market and staying ahead of major macro trends is just as important as everything else. The all-important price of gold, which gold companies have zero control over, is a crucial factor that often holds the key to success and the ability to raise capital.

With the threat of inflation rising, in the wake of unprecedented stimulus in 2020 and 2021, gold and related junior gold stocks have the potential to become sought-after assets.

If you’re not already a member of our newsletter and you invest in TSX Venture and CSE stocks, what are you waiting for? Subscribe today. Only our best content will land in your inbox.