The U.S. Dollar remains under pressure amidst many factors, including soaring deficits and an increasing money supply.

Epic Economist believes recent data highlights the demand for things people need in the post-Covid world. The change in buying habits is driving inflation in many consumer goods, including the cost of food.

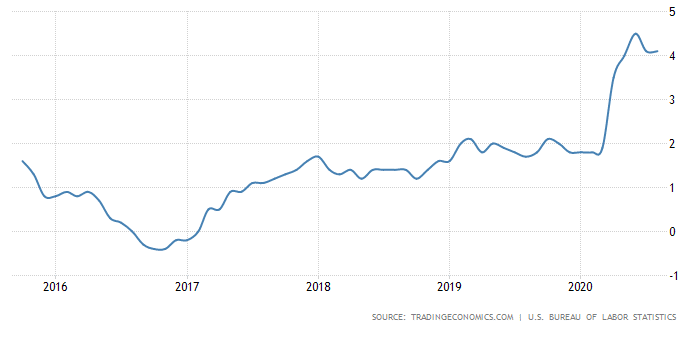

According to Trading Economics,

“Cost of food in the United States increased 4.10 percent in August of 2020 over the same month in the previous year.”

United States Food Inflation

Higher food costs should come as no surprise given the money supply is exploding in the U.S. Commerzbank commodity analyst Carsten Fritsch spoke to the rising money supply recently,

“The U.S. M1 money supply soared by 40% year-on-year in August as a result of the Fed’s ultraloose monetary policy, for example.”

Prices for Used Cars and Trucks Rise

Epic Economist cites a recent rise in used cars and trucks, pointing to BLS data that showed a 5.4% increase in August. While the US CPI continues to avoid food and energy prices, inflation denial can only last so long. As prices for not only food and energy rise, eventually inflation will hit items measured by the CPI. Lumber and construction prices are two areas seeing significant prices increases.

The Federal Reserve will continue to target higher inflation and keep interest rates at zero for as long as possible or take them negative to achieve it. We wrote about the record negative correlation between U.S. equities and the U.S. dollar in Trump Could Be Done if this Doesn’t Happen ASAP.

With the U.S. Presidential election less than one month away, every day counts, and the Fed and Trump know a declining dollar will make investors feel richer in the short term. The effect on the consumer is entirely different but harder to notice.