We introduced Rritual Superfoods (“Rritual” or the “Company”) (CSE: RSF) in early March, just before the Company began trading publicly in Canada.

Rritual Superfoods’ shares came to trade on March 8, 2021, a day following our Weekly Intelligence Newsletter focused on the Company and titled, New IPO: Mental Fitness & Functional Mushrooms.

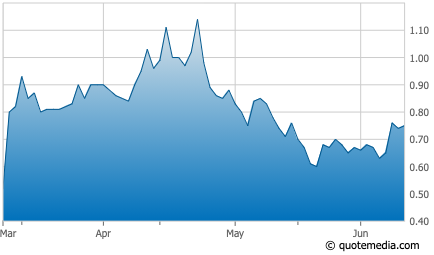

After trading between a low of CAD$0.36 and a high of CAD$0.59 per share in its first three trading days, Rritual Superfoods’ share price took off higher…

By March 16th, the Company hit a high of CAD$0.99 per share; and on April 26th, its stock briefly touched an all-time high of CAD$1.17 — representing roughly a 100% increase from its price range in its first three days of trading as a public company. Since then, as with many other microcaps, Rritual’s stock price has come off, closing Friday at CAD$0.80.

However, from a business development standpoint, Rritual Superfoods has delivered on several material accomplishments since going public…

In the last three months, the Company announced a few key developments, including: a partnership with CROSSMARK Inc., a planned retail rollout with Rite Aid, and a non-binding Letter of Intent with NEXE Technologies Corp. And already, Rritual Superfoods has surpassed its 2021 retail distribution targets in the USA.

Furthermore, the Company announced on Thursday that it,

“…has received purchase orders totaling CAD $306,000 in the last week of May, with goods now shipping to customers.”

Click here to read full press release.

As shareholders of Rritual Superfoods, we appreciate the pace of development the Company has demonstrated since going public roughly three months ago.

What is Rritual Superfoods?

Rritual is a plant-based consumer wellness brand dedicated to creating simple, pure, yet effective plant-based health products. The Company creates plant-based elixirs which support immunity, focus, and relaxation.

Backed by a leading team of scientists, doctors, nutritionists, and experts across the wellness space, Rritual Superfoods has entered the market with their flagship collection of certified organic Mushroom and Adaptogen Elixir Mix powders. The Company offers products in the top three need-state health categories: Lion’s Mane Focus, Reishi Relax, and Chaga Immune.

Rritual’s product packaging (which can be seen in our video below) is A+; it’s elegant and eye-catching, and we believe it will command consumers’ attention. We’ve personally tried each of Rritual’s aforementioned products and enjoyed their calming, full-bodied, herbal flavours.

Despite being a relatively new publicly traded company, Rritual Superfoods’ team has tremendous experience in the CPG space. They boast over 100+ years of combined specialty CPG experience, having worked with leading brands such as Celsius Beverages, Nude Beverages, Gaia Herbs, MegaFoods, Nutiva, and Danone.

Rritual’s strategic focus is on building a national presence in the USA…

Just this past week, Rritual announced that it has surpassed its retail distribution targets for the end of 2021, exceeding 2400 retail locations and 10,000 points of distribution within the first half of the year.

In that same press release, CEO David Kerbel remarked,

“We are revising our targets based on the current lineup of sku’s to reach 6000 stores and 20,000 points of distribution this year, delivering on our brand promise to bring Rritual within arm’s length of consumer desire.”

Click here to read the full press release.

The Rite Aid Deal

On March 30th, Rritual announced that,

“…the Company’s premium brand of functional superfoods will launch in Rite Aid stores throughout the USA in Q2 and Q3.”

According to Rritual’s press release,

“Rite Aid Corporation, the third largest US drugstore chain, is on the front lines of delivering healthcare services and retail products to more than 1.6 million Americans daily…”

The release also stated:

“Rite Aid will carry Rritual’s full product line, including:

-

Chaga IMMUNE with adaptogens Eleuthero Root and Astragalus to support healthy immune function and well-being all year round.

-

Lion’s Mane FOCUS with adaptogens Rhodiola Rosea Root and Bacopa to support brain health and cognitive function.

-

Reishi RELAX with adaptogen Ashwagandha and cacao to help the body adapt to stress.”

“This first national retail rollout is a major achievement for the Rritual brand. It validates both supply and demand for the category, specifically, our product quality and the rapidly growing interest of consumers in functional superfoods,”

said Mr. David Kerbel, Rritual Superfoods CEO.

Click here to read the full press release.

The CROSSMARK Partnership

The second material development we want to highlight since the Company went public is Rritual’s partnership with CROSSMARK Inc. (“CROSSMARK”).

For more than 100 years, CROSSMARK has accelerated the world’s most influential companies — ultimately driving sales and managing brand success. David Kerbel’s (Rritual’s CEO) background in the CPG space opened the door to this opportunity.

Jim Badalati, CROSSMARK’s SVP of Customer Development West, stated that,

“We are looking forward to partnering with David and the Rritual team. David and I started at CROSSMARK together over 20 years ago and are aligned with doing things right the first time.”

CROSSMARK’s core services include Headquarter Sales, Retail Services, and Marketing Services. CROSSMARK appears uniquely positioned to help with Rritual’s rollout.

Rritual’s press release stated:

“Their team of 25,000+ employees are responsible for servicing all major retailers throughout North America—from buying desks to consumer baskets. Additionally, their unparalleled eCommerce and omnichannel expertise continue to innovate the industry, well beyond brick and mortar.”

Click here to read the full press release.

We caught up with Rritual’s CEO, David Kerbel this past week. He answered our questions related to the aforementioned milestones that are geared toward growing the Company’s presence in the United States…

Pinnacle Digest: Where are things currently at with your planned rollout with Rite Aid. Are Rritual’s products on Rite Aid’s shelves?

David Kerbel: We are in process with Rite Aid. Our products will be on shelves throughout the country within the next 60 days.

Pinnacle Digest: We want to know more about CROSSMARK, where you were a former executive. Can you tell us how the partnership could help drive awareness and sales for Rritual?

David Kerbel: CROSSMARK will allow us to gain distribution in over 6000 stores and over 20,000 points of distribution this year. They use their unique blend of 25,000 employees, armed with the latest technology and a deep understanding of what customers are looking for.

Pinnacle Digest: In late April, the Company reported on its third full-scale manufacturing run nearing completion. How has that come along, and what kind of scale is the Company capable of attaining in 2021?

David Kerbel: With our latest production run completed, and our next one scheduled, we are well positioned to handle the deluge of orders that we will be receiving through this calendar year.

The Wrap

Demand for plant-based consumer wellness products has increased significantly, with no indications of slowing down. We wrote about this in our initial report on Rritual, New IPO: Mental Fitness & Functional Mushrooms, which we encourage everyone to read.

We hope this report provides a high-level overview of Rritual Superfoods’ recent developments and its near-term plans, but it is not intended to be exhaustive. Recognize that we are biased when it comes to Rritual. The Company is a sponsor and client of Pinnacle Digest, and we own shares and warrants of Rritual, making us cheerleaders and shareholders. Conduct your own thorough and independent due diligence to properly understand the risks associated with investing in a speculative company of this nature. A good place to start your due diligence is reviewing the Company’s Sedar filings at www.sedar.com.

Since going public roughly 3 months ago, Rritual’s stock price has been volatile, touching as low as CAD$0.36 on its first trading day, and reaching a high of CAD$1.17 in April. The Company’s stock closed trading on Friday at CAD$0.80.

Rritual Superfoods 3-Month Stock Chart (CSE: RSF)

In the small and micro-cap space, it’s often argued that the most valuable asset a company has is its management team. Hard to disagree. The reasoning behind that is due to the high level of execution risk smaller companies typically have. So, for a small company to be successful over the long-term, it must follow through on its development plans as scripted. Talk is cheap, in other words…

To date, Rritual and its team have delivered on several key milestones — demonstrated, in part, by its agreements with CROSSMARK and Rite Aid. The 2nd half of 2021 will be very important for the Company, and will determine whether Rritual Superfoods (CSE: RSF) hits its revenue targets in its first year as a publicly traded company.

All the best with your investments,

PINNACLEDIGEST.COM

Disclosure, Compensation, Risks Involved and Forward-Looking Statements:

You must read the following carefully before proceeding.

THIS REPORT IS NOT INVESTMENT ADVICE, NOR A RECOMMENDATION TO PURCHASE ANY SECURITY, NOR IS IT INTENDED TO BE A COMPLETE OVERVIEW OF RRITUAL SUPERFOODS INC. THE INFORMATION IN THIS REPORT IS NOT A SUBSTITUTE FOR INDEPENDENT PROFESSIONAL ADVICE. SEEK THE ADVICE OF YOUR FINANCIAL ADVISOR AND A REGISTERED BROKER-DEALER BEFORE MAKING ANY INVESTMENT DECISIONS.

All statements in this report are to be checked and verified by the reader.

This report may contain technical or other inaccuracies, omissions, or errors, for which Maximus Strategic Consulting Inc., owner of PinnacleDigest.com (“Pinnacle Digest” or “Maximus” or “we”), assumes no responsibility. We cannot warrant the information contained in this report to be exhaustive, complete or sufficient. This report does not purport to contain all the information that may be necessary or desirable to fully and accurately evaluate an investment in Rritual Superfoods Inc. (“Rritual” or the “Company”). Rritual is a client and sponsor of PinnacleDigest.com. PinnacleDigest.com authored and published this report. Because we are paid by Rritual, and therefore we are not independent reporters, our coverage of Rritual features many of its positive aspects, and not the potential risks to its business or to investing in its stock.

Important: Our disclosure for this report on Rritual Superfoods Inc. applies to the date this report was posted on our website (June 13, 2021). This disclaimer will never be updated, even if we buy or sell shares of Rritual Superfoods Inc.

Do Your Own Due Diligence: An investment in securities of Rritual should only be made by persons who can afford a significant or total loss of their investment. Rritual’s stock price is volatile, and its shares may be thinly traded. The value of the Company’s securities may experience significant fluctuations due to many factors, some of which could include operating performance, performance relative to estimates, disposition or acquisition by a large shareholder, a lawsuit against Rritual, the loss or acquisition of a significant customer, industry-wide factors, and general market trends. There can be no assurance that an active trading market for Rritual’s common shares will be established and sustained.

In all cases, interested parties should conduct their own investigation and analysis of Rritual, its assets and the information provided in this report. Readers should refer to Rritual’s public disclosure documents found on the SEDAR website (www.sedar.com) before considering investing in the Company. The public disclosure documents will help investors understand Rritual’s objectives and the risks associated with the Company.

The securities of Rritual are highly speculative due in part to the nature of the Company’s plans/objectives, its early stage of business development and limited operating history, the highly competitive industry it operates in, and Rritual’s negative operating cash flow. Rritual is therefore subject to many of the risks common to early-stage enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial, and other resources and lack of revenues. The Company has limited financial resources, and no assurances that sufficient funding, including adequate financing, will be available to advance its objectives. If the Company’s generative commercialization and development programs are successful, additional funds will be required for development of one or more initiatives. The Company may seek such additional financing through debt or equity offerings. Any equity offering will result in dilution to the ownership interests of the Company’s shareholders and may result in dilution to the value of such interests. Failure to obtain additional financing could result in the delay or indefinite postponement of further business development.

There can be no certainty that Rritual will be able to implement successfully the objectives and strategies described in this report. A prospective investor should consider carefully the risk factors set out in this disclosure statement, the Company’s prospectus dated February 26, 2021, Rritual’s annual and quarterly Management’s Discussion and Analysis, and in other filings made by Rritual with Canadian securities regulatory authorities available at www.sedar.com under the Company’s issuer profile.

Important: Please be aware and note the date this report was published (June 13, 2021). As a result of the passing of time, the relevancy of the opinions and facts in this report are likely to diminish and may change. As such, you cannot rely on the accuracy and timeliness of the information provided in this report. Since there is no specific guideline as to how long this report may remain relevant, you should consider that it may be irrelevant shortly after its publication date.

The statements and opinions expressed by representatives of Pinnacle Digest are solely those of Pinnacle Digest and not the opinions of Rritual. The statements and opinions expressed by representatives of Rritual are solely those of Rritual and not the opinions of Pinnacle Digest.

Unless otherwise indicated, the market and industry data contained in this report is based upon information from industry and other publications and the knowledge of Pinnacle Digest and Rritual. While Pinnacle Digest believes this data is reliable, market and industry data is subject to variations and cannot be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey. Pinnacle Digest has not independently verified any of the data from third-party sources referred to in this report or ascertained the underlying assumptions relied upon by such sources.

Cautionary Note Regarding Forward-Looking Information:

This report contains “forward-looking information” within the meaning of Canadian securities legislation (collectively, “forward-looking statements”). All statements, other than statements of historical fact, that address activities, events or developments that Rritual or Pinnacle Digest believes, expects or anticipates will or may occur in the future are forward-looking statements. Such forward-looking statements also include, but are not limited to, statements regarding: the future financial position, business strategy and objectives, potential acquisitions and partnerships, budgets, projected costs, and plans of or involving Rritual; future growth predictions for the wellness, functional mushrooms, and adaptogens industries; consumer preferences and tastes; Rritual being in a growth phase; the Company’s plans to leverage third party manufacturing and logistics; the Company’s broader retail distribution plans; Rritual positioning itself to become a leader in a market segment with strong growth projections; market forecasts and predictions; the nature of potential business acquisitions and partnerships; the timing and the completion of various development projects; Rritual and its products being able to help consumers with their mental well-being; future product offerings from Rritual; the Company’s intention to grow its business and operations; the future performance of Rritual; the expected timing and completion of Rritual’s near-term and long-term objectives, including revenue and volume targets; the regulatory environment; Rritual’s current lineup of SKUs reaching 6000 stores and 20,000 points of distribution in 2021; Rite Aid indicating that 20% more stores than anticipated will carry Reishi Relax, Chaga Immune, and Lion’s Mane Focus as well as 100% more Rite Aid locations carrying the Company’s Variety Pack; CROSSMARK appearing uniquely positioned to help with Rritual’s rollout; CROSSMARK’s unparalleled eCommerce and omnichannel expertise continuing to innovate the industry, well beyond brick and mortar; the Company’s ability to become a premium brand within its industry; potential growth catalysts for the Company; Rritual’s sales and distribution strategy; the potential impact of Rritual’s products on consumers’ lives; the Company being able to leverage its expertise and leadership team to grow its business; the competitive advantages of Rritual and its proposed product offerings; entering into new and emerging markets; Rritual’s ability to scale production and the reliability of its supply chain; the efficacy and benefits of Rritual’s proposed product offerings; functional mushrooms and adaptogens providing natural health and/or healing benefits; the Company’s ability to expand its sales and distribution channels; the number of stores and points of distribution Rritual’s products will be available in in 2021 from a quarterly and annual basis; retailer commitments to carrying the Rritual brand; the level of interest among consumers for wellness solutions; David Kerbel’s previous experience in the consumer packaged goods industry being a benefit to Rritual; the quality of Rritual’s product packaging; Rritual being able to capitalize on the growing demand for functional mushrooms; Rritual’s products capturing the attention of consumers in retail locations and online stores; Rritual’s product packaging, design, and formulations standing out amongst competitors; Rritual’s elixir line being set to capture significant market share; the Company being able to attract and retain key personnel; currency exchange and interest rates; the impact of competition; functional mushrooms and adaptogens being an emerging consumer trend; future changes and trends in Rritual’s industry or the global economy; the Company being able to achieve and sustain profitability, and other estimates or expectations.

Information provided relating to projected costs, capital expenditure, production profiles and timelines are expressions of judgment only and no assurances can be given that actual costs, production profiles or timelines will not differ materially from the estimates contained in this report.

Often, but not always, these forward-looking statements can be identified by the use of forward-looking terminology such as “expects”, “expected”, “budgeted”, “targets”, “forecasts”, “intends”, “anticipates”, “scheduled”, “estimates”, “aims”, “will”, “believes”, “projects”, “could”, “would”, and similar expressions (including negative variations) which by their nature refer to future events.

By their very nature, forward-looking statements are subject to numerous risks and uncertainties, some of which are beyond Rritual’s control. These statements should not be read as guarantees of future performance or results because a number of assumptions and estimates have been made, and they may prove to be incorrect. Forward-looking statements are based on the opinions and estimates of Rritual’s management or Pinnacle Digest at the date the statements are made. In this report, assumptions and estimates may have been made regarding, among other things, future demand for the Company’s offerings; that consumer buying patterns will increase in specialty and grocery stores; Rritual being able to fund its development plans; Rritual being able to secure future financing to meet its growth targets; Rritual successfully completing its development and growth plans, and doing so on schedule; Rritual being able to get its proposed products into retailers; Rritual’s ability to scale its operations; Rritual’s e-commerce platform operating as intended; economic conditions in the United States and Canada continuing to show modest improvement in the near to medium future; the efficacy of functional mushrooms, adaptogens, and Rritual’s products; no material changes to the tax and other regulatory requirements governing the Company; the competitive environment; that there will be no material change to the competitive environment in the distribution of mushroom-based food additives and supplements; the ability of the Company to maintain or accurately forecast revenue; the Company being able to identify, hire, train, motivate, and retain qualified personnel; the ability of the Company to develop, introduce, and implement new offerings as well as enhancements or improvements for existing offerings; risks associated with operations; the impact of any changes in the laws and regulations in the jurisdictions in which the Company operates; Rritual’s ability to carry on current and future operations; that the average cost of mushroom powder will fluctuate in line with historical trends; the Company being able to develop distribution channels and a customer base; the ability of the Company to meet current and future obligations; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the current and future social, economic and political conditions; currency exchange rates; capital costs; the future size of the markets that Rritual intends to service, and other assumptions and factors generally associated with the CPG, wellness, dietary supplement and functional mushroom industries. We caution all readers that the foregoing list of assumptions and estimates is not exhaustive.

Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of Rritual to differ materially from those discussed in the forward-looking statements in this report and, even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, Rritual. Factors that could cause Rritual’s results to differ materially from those expressed in forward-looking statements in this report include, but are not limited to, the following risks and uncertainties: any development activities Rritual may conduct which may not produce favourable results; changes in consumer preferences, demand and perceptions; a lack of brand awareness; reliance on third parties for products, packaging, supplies and/or services critical to the Company’s operations; partnerships and agreements made by the Company with third parties may not materialize as projected or intended; reliance on third-party organizations to process, manufacture, and ship the Company’s products; the fact that the Company does not own or operate any production facility and that its co-packer(s) may not renew current agreements and/or not satisfy increased production quotas; general business and economic conditions may limit the Company’s ability to obtain necessary capital to carry out all of its business plans; the overall performance of stock markets; the Company may not have adequate product liability insurance coverage; volatility in the Company’s stock price; foreign exchange fluctuations; the consequences of competitive factors in the industries in which Rritual operates may restrict the success of any offering the Company is able to commercialize or develop; increased competition by larger and better financed competitors; the impact of the COVID-19 pandemic on the Company’s ability to operate; the inherent uncertainties associated with operating as an early stage company; the Company’s limited operating history and lack of historical revenue; dependence on obtaining and maintaining regulatory approvals; developments and changes in laws and regulations, including increased regulation of the Company’s industries and the capital markets; increased scrutiny from federal, state and local governmental authorities pertaining to the dietary supplement industry; regulatory changes requiring extensive and/or costly changes to the Company’s operations; economic and financial conditions; failure to retain, secure and maintain key personnel and strategic partnerships including but not limited to executives, researchers, distributors, customers and suppliers; failure to develop and gain regulatory approval for any offerings or products; interest rate volatility; supply and demand for health and wellness products and ingredients; a decline in market sentiment; significant inflation or deflation; the Company not being able to develop new and innovative products; negative operating cash flow; anticipated growth may not materialize; increased costs of being a publicly traded company; the effectiveness of the Company’s products; regulatory failings; privacy breaches; the corporate governance required for Rritual; the Company’s ability to generate sufficient cash flow from operations to meet its current and future obligations; the Company’s ability to scale its operations as expected; the potential for issues which could expose the Company to legal liability that may harm its business or reputation; the Company may not be able to raise the additional funding required to complete its development plans and to continue to pursue its other business objectives; conflicts of interest; officers and directors allocating their time to other ventures; the willingness of third parties to sign agreements with Rritual on terms that are acceptable to management of Rritual; management’s ability to manage growth; major changes in the political and economic environment of Rritual’s fields of activity; product recalls or discontinuance of products; revised or additional labeling being required on packaging; risks related to the response-time that might be needed in case of totally unexpected events in areas relevant to Rritual’s field of activity; research and development delays; failure to develop and successfully market new offerings at favourable margins, or at all; market perception of junior companies such as Rritual may change; intellectual property risks, including the intellectual property of others and any asserted claims of infringement; liquidity, dilution and future issuances of equity; the Company may not be able to acquire a sufficient amount of mushroom powders; unanticipated problems related to Rritual’s business objectives; supply chain disruptions; product obsolescence; the Company’s ability to obtain and/or maintain any necessary permits, consents or authorizations required to pursue its business objectives; general business, economic, geopolitical and social uncertainties; functional mushrooms, adaptogens, and Rritual’s products may not provide immunological or health benefits as intended; the risk of claims and legal actions against the Company in respect of which insurance is not available, and other risks pertaining to the CPG, wellness, dietary supplement and functional mushroom industries as well as those factors discussed in the section entitled “Risk Factors” in Rritual’s Annual and Quarterly Reports, its prospectus dated February 26, 2021, and associated financial statements, Management Information Circulars, and other disclosure documents filed with Canadian securities regulators. The Company’s filings can be found on the SEDAR website (www.sedar.com) under Rritual’s issuer profile.

Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking information contained in this report or incorporated by reference are made as of the date of this report (June 13, 2021) or as of the date of the documents incorporated by reference, as the case may be, and Pinnacle Digest does not undertake to update any such forward-looking information, except in accordance with applicable securities laws. Accordingly, readers are cautioned not to place undue reliance on forward-looking information because we can give no assurance that such expectations will prove to be correct. Should one or more of the aforementioned risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as anticipated, believed, estimated, or expected.

We Are Not Financial Advisors: This report does not constitute an offer to sell or a solicitation of an offer to buy Rritual’s securities. Be advised, Maximus Strategic Consulting Inc., PinnacleDigest.com and its employees/consultants are not a registered broker-dealer or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

PinnacleDigest.com is an online financial newsletter owned by Maximus Strategic Consulting Inc. We are focused on researching and marketing for small public companies. This report is intended for informational and entertainment purposes only. The author of this report and its publishers bear no liability for losses and/or damages arising from the use of this report.

Never, ever, make an investment based solely on what you read in an online newsletter, including Pinnacle Digest’s online newsletter, or Internet bulletin board, especially if the investment involves a small, thinly-traded company that isn’t well known.

We Are Biased: Rritual is a client of ours (details in this disclaimer on our compensation). We also own shares and warrants of the Company. For those reasons, we want to remind you that we are biased when it comes to Rritual.

Because Rritual has paid us CAD$200,000 plus GST for our online advertising and marketing services, and we (Maximus Strategic Consulting Inc.) own shares and warrants of the Company, you must recognize the inherent conflict of interest involved that may influence our perspective on Rritual; this is one reason why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before considering investing in the Company. Investigate and fully understand all risks before investing.

PinnacleDigest.com is often paid editorial fees for its writing and the dissemination of material. The clients (including Rritual) represented by PinnacleDigest.com are typically early-stage companies that pose a much higher risk to investors than established companies. When investing in speculative stocks such as Rritual it is possible to lose your entire investment over time or even quickly. Rritual is not an appropriate investment for most investors.

Important: Set forth below is our disclosure of compensation received from Rritual and details of our stock ownership in the Company as of June 13, 2021:

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, has been paid CAD$200,000 plus GST to provide online advertisement coverage for Rritual for a six-month online marketing agreement. Rritual paid for this coverage. The coverage includes, but is not limited to, the creation and distribution of reports authored by PinnacleDigest.com about Rritual (reports such as this one), as well as display advertisements and news distribution about the Company on our website and in our newsletter. We (Maximus Strategic Consulting Inc.) own shares and warrants of Rritual which were acquired by participating in the Company’s Initial Public Offering (click here for information about Rritual’s IPO). We intend to sell every share we own of Rritual for our own profit. All shares Maximus Strategic Consulting Inc. currently owns or may purchase in the future of Rritual will be sold without notice to PinnacleDigest.com’s subscribers or the general public. Maximus Strategic Consulting Inc. benefits from price and trading volume increases in Rritual, and is therefore extremely biased when it comes to the Company.

Rritual is a Very Risky Investment: Rritual is an early-stage company operating in an evolving industry with substantial competition and potential challenges. Rritual poses a much higher risk to investors than established companies. It is not an appropriate investment for most investors. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time or even quickly.

The Company and its business prospects must be viewed against the background of the risks, expenses and problems frequently encountered by companies in the early stages of their development, particularly companies in new and evolving markets.

History of Operating Losses: Rritual has a relatively limited operating history from which an investor can evaluate its business and prospects. Since inception, the Company has had negative operating cash flow and incurred losses. The Company’s negative operating cash flow and losses are expected to continue for the foreseeable future. We cannot predict when Rritual will reach positive operating cash flow, if ever. Due to the expected continuation of negative operating cash flow, the Company will likely be reliant on future financings in order to meet its cash needs. There is no assurance that such future financings will be available on acceptable terms or at all. If the Company sustains losses over an extended period of time, it may be unable to continue its business.

While the information contained in this report has been prepared in good faith, neither Maximus Strategic Consulting Inc. nor Pinnacle Digest, give, have given or have authority to give, any representations or warranties (express or implied) as to, or in relation to, the accuracy, reliability or completeness of the information in this report (all such information being referred to as “Information”) and liability therefore is expressly disclaimed to the fullest extent permitted by law. Accordingly, neither Maximus Strategic Consulting Inc., nor any of its shareholders, directors, officers, agents, employees or advisers take any responsibility for, or will accept any liability whether direct or indirect, express or implied, contractual, tortious, statutory or otherwise, in respect of, the accuracy or completeness of the Information or for any of the opinions contained in this report or for any errors, omissions or misstatements or for any loss, howsoever arising, from the use of this report.

PinnacleDigest.com’s past performance is not indicative of future results and should not be used as a reason to purchase any security mentioned in this report or on our website.

The past successes of members of Rritual’s management team, board of directors, and advisory team are not indicative of future results for the Company.

Maximus Strategic Consulting Inc. and PinnacleDigest.com (including its employees and consultants) are not chartered business valuators; the methods used by business valuators often cannot justify the trading price for most junior stock exchange listed companies, including Rritual.

Any decision to purchase or sell as a result of the opinions expressed in this report OR ON PinnacleDigest.com will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Our views and opinions regarding the companies we feature on PinnacleDigest.com and in this report are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this report (specifically Rritual) or on PinnacleDigest.com will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, does not undertake any obligation to publicly update or revise any statements made in this report.

Learn how to protect yourself and become a more informed investor at www.investright.org

Trading in the securities of Rritual is highly speculative.

To get an up-to-date account on any changes to our disclosure for Ritual Superfoods Inc. (which will change over time) view our full disclosure at the url listed here: https://www.pinnacledigest.com/disclosure-compensation/.