The TSX Venture cleared 900 again in early trading Wednesday. The exchange put in an epic run in 2020 and shows no signs of slowing down this year. What continues to stand out to me is the number of sectors heating up and the increased liquidity. Take a look at the Venture over the past 12 months:

TSX Venture – 1 Year Chart

The Venture cleared 900 four times in early 2018 as the cannabis market peaked but failed to close above 900 on any of those trading days. In fact, Tuesday’s close of 899.85 is the highest close on the Venture since September of 2014! The TSX Venture is in a raging bull market led by increasing daily volumes. With the Democrats on track to pull off a historic election win in Georgia, the Biden Presidency is poised to take control of the House and Senate. So, this all but gaurantees more spending and even higher deficits. While the long-term effect of this will likely be tragic, it may fuel the overall speculative frenzy and boost asset classes such as Bitcoin and gold in the short-term.

TSX Venture Liquidity Soars

We have not seen such liquidity in nearly a decade. The Venture is routinely trading more than 100 million total shares in a day in recent weeks. The junior exchange saw 160 million traded on December 29th, 157 million on January 4th, and 143 million on January 5th. Check out the volume at the bottom of the chart below:

Compare this to January and February of last year, where the volume fluctuated between 50 and 80 million shares per day. So, we have an exchange that has gone from the 500s to about 900, while its average volume has nearly doubled. We are witnessing mass liquidity across numerous sectors from palladium to gold, gaming, and tech, psychedelics, and wellness.

I see two key things fueling this rally, and neither seem likely to end anytime soon—the first is massive savings across most of Canada due to the pandemic.

Excess Cash and Free Money Fueling Stock Market Rally

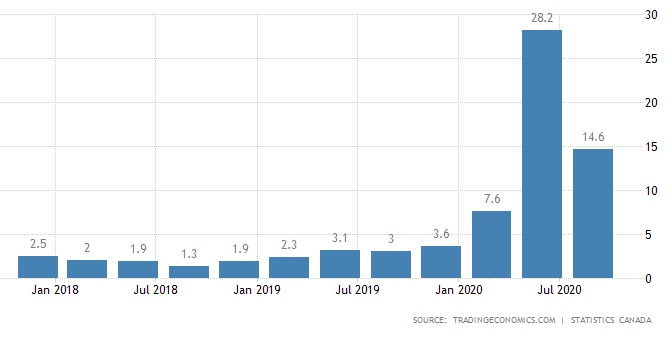

Canada Household Saving Rate Soars in 2020

Towards the end of last year, The Financial Post ran an article that highlighted this, writing,

“Frugal Canadian households and businesses have accumulated a minimum of $170 billion in excess cash throughout COVID-19 and are currently sitting on the largest cash hoard in recorded history, according to CIBC.”

As investors work from home or take time off work during the pandemic, smartphone use is soaring. emarketer.com reported in June of 2020 that,

“The average US adult will spend 23 additional minutes per day on their smartphones in 2020, a big increase from our pre-pandemic estimates.”

I believe the increase is probably more significant today amidst the second wave. People are bored. They are spending more time at home, more time on their phones and have more disposable cash. Online discount brokerage app use is exploding and for many millennials and those with capital, they are looking for investment opportunities with this extra time. As US equities continue to hit new all-time highs, people are embracing the rally and speculating.

Lowest Interest Rates Ever Force Investors to Speculate

The second major factor driving speculation and valuations on the TSX Venture has to be record-low interest rates. While rates were low last year, they weren’t this low. And, these record-low rates are boosting asset values across the spectrum. From hockey cards to home prices, inflation is permeating almost anything of value due to cheap money. The Venture and well-positioned deals on the exchange that control real hard assets such as commodities are benefiting.

In December, HSBC, Canada’s 7th largest bank, began offering variable mortgage rates below 1% – 0.99% to be exact. So, while the Bank of Canada’s key interest rate remains at 0.25%, where it has been since March, banks are lowering their rates. We are witnessing a race to the bottom (think Europe with its negative rates), which is reducing mortgage payments and boosting home prices.

The average price of homes sold in Greater Toronto hit a record last year. Global News reports this morning that,

“The board says the average selling price in Greater Toronto was $929,699 in 2020, up 13.5 per cent from $819,279 compared with 2019.”

You Can See and Feel Inflation Everywhere

Home prices are up 13.5%, but they tell you inflation is 1% or lower? Inflation is running hot right now and it can be seen across almost all asset classes, including Canada’s junior exchange. So, while the Venture bumps up against 900 and records its highest close at 899 since 2014, we shouldn’t be too surprised. A spike in savings, record high stock prices in the US dominating headlines, and cheap money eternal will continue to feed the speculative frenzy on the TSX Venture.