The pandemic has opened up a pandora’s box of social spending, unlike anything we’ve seen before. In the fiscal year 2020/21, the budget deficit totaled $314.00 billion, up from ‘just’ C$21.77 billion in the previous year. And, with the Liberals poised to win a majority this summer potentially, the future of deficit spending and the inflation that comes with it, is as uncertain as ever. All of this cheap money is causing prices to rise as the ‘inflation tax’ hits home.

Cornucopia of Spending Sends Inflation to New Highs

Not all Canadians are taking our spendthrift government sitting down. Conservative Pierre Poilievre from Carleton, Ontario, sounded off on an issue facing many Canadians today: inflation. The culprit? He believes it is due mainly to the new money created over the past year and a half.

Poilievre discusses the Bank of Canada’s inflation target,

“Starting in 1991, the bank and the government signed a deal that inflation would be targeted between 1-3% – they called it the “monetary policy framework.” Sleepy, boring words that may impact your financial health more than anything else that happens here in parliament. Now, that deal to target to inflation renews every five years.”

On October 24th of this year, the deal is up for renewal. Poilievre is concerned that if Trudeau and the Liberals are re-elected, they may alter or change the inflation target in a late-summer election. Moreover, the staunch conservative believes this is an invisible tax that hurts the working poor while enriching those with assets such as real estate.

Inflation Tax Hitting Canadians Hard

The inflation tax is a significant issue for discussion in the United States and Canada as inflation soars. Poilievre notes,

“New cash creation constituted $303 billion dollars of the sources of revenue of this government. Now, the Prime Minister might like to see this go on into the future. The problem is, like all taxes, it increases costs on Canadians. And, how do you pay this tax? In the form of higher prices.”

Poilievre cited rising prices in houses, food, automobiles, lumber, and many other consumer prices.

“When money is cheap, everything else suddenly gets expensive.”

– Pierre Poilievre

In an illuminating series of quotes, beginning with a 1978 lecture by Milton Friedman on the rising quantity of money,

Poilievre quotes Friedman, stating,

“Inflation is taxation without legislation.”

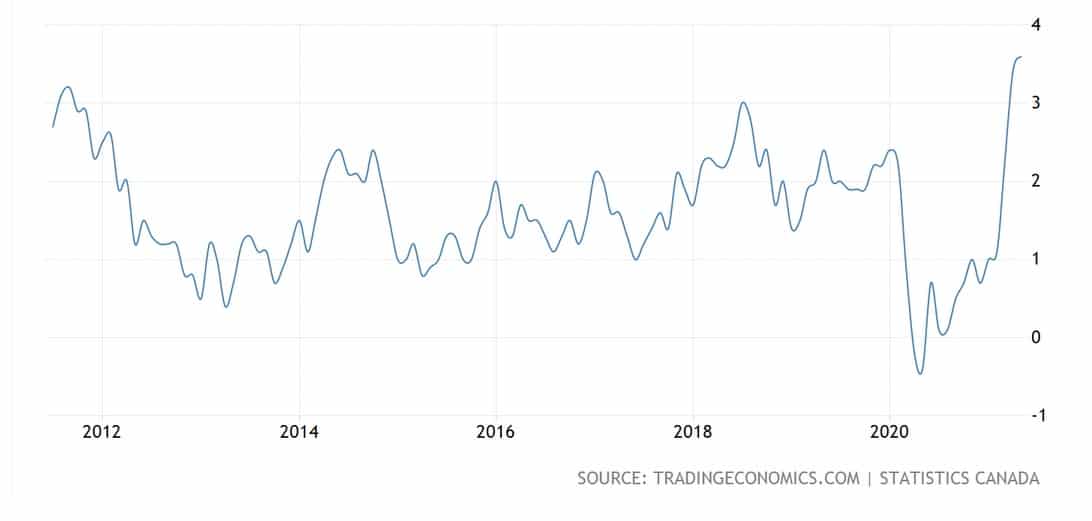

Poilievre goes on and on about the ills of unchecked inflation and specifically on who wins and who loses. The taxation effect of inflation is real and happening right now. Canada’s inflation rate remains above a 10-year high, pushing the inflation tax higher.

Finally, Poilievre concludes with a powerful statement,

“That governments including central banks cannot tax, what the commoners have not approved. That the principle of responsible government remains. That parliament reigns supreme. That citizen goes before state and commoner ahead of crown.”