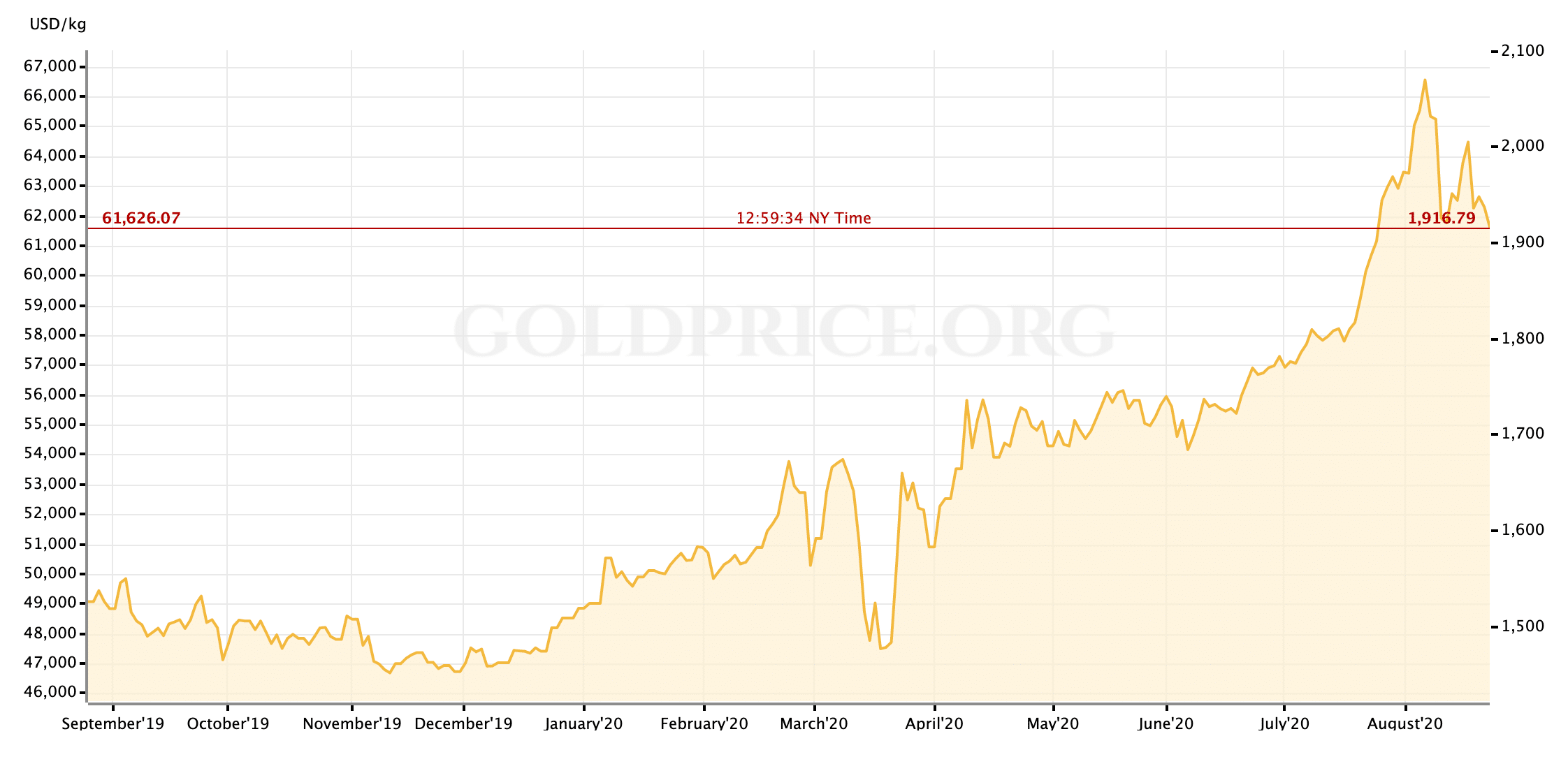

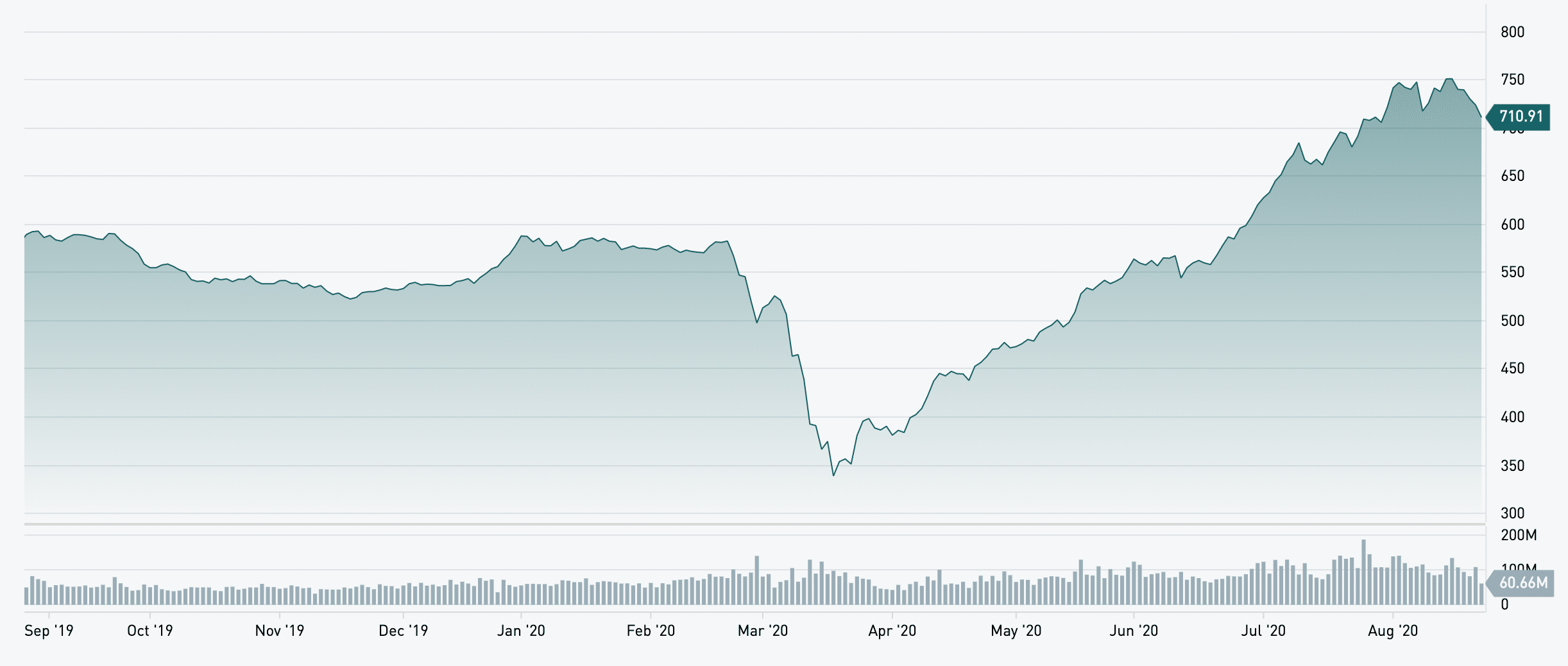

It’s clearer than ever before that gold moves the TSX Venture.

Fueled by gold’s rise, the TSX Venture – which is home to over 900 mining/exploration companies, the vast majority of which are junior gold miners – soared from a March low of 338.80 to a high of 761.84 this month, marking a gain of almost 125%.

Now, after a correction in the price of gold this month (gold fell from a high of US$2,070.05/oz on August 6 to US$1,928.11/oz by August 25), the Venture is trading lower at 710.42.

Although the TSX Venture doesn’t track gold’s performance perfectly, it’s eerily close. Just look at the two charts below.

1-Year Chart of the Price of Gold

1-Year Chart of the TSX Venture Index

When gold rises or falls, so too does the TSX Venture. But there’s a catch to all of this…

While many gold companies on the TSX Venture are thriving in today’s macroeconomic environment, the same cannot be said for the junior exchange’s technology companies.

Despite the NASDAQ (the bellwether exchange for technology companies) crushing all-time high after all-time high, TSX Venture technology companies appear to be struggling; the TSX Venture Information Technology Sector Index currently trades around May 2019 levels, when the NASDAQ was almost 4000 points lower than it is today…

In other words, investor sentiment for technology in the U.S. appears to have little to no bearing on investor sentiment for junior technology companies in Canada.

The lack of enthusiasm for Canadian junior technology companies is especially concerning when one considers the nature of capital flows. With junior miners raising the lion’s share of investment capital on the TSX Venture this year, junior technology companies have been left with the scraps. Combined with the economic headwinds created by COVID-19, reduced tech financings could spell trouble ahead for already cash-strapped junior tech companies.

What Lies Ahead for the TSX Venture?

“When it comes to the Canadian public markets, small and micro-cap stocks are usually the laggards of the bunch — the first to fall and the last to rise. And when junior exchanges like the TSX Venture and the CSE fall, they fall hard. It can take months (and even years) for them to recover and pick up momentum again. Just look at the charts of either of Canada’s junior exchanges over the past 2 years…”

While the TSX Venture has certainly regained some momentum this year, it has required the price of gold and the NASDAQ to hit new all-time highs for it to do so. In other words, the stars have had to align for the TSX Venture to return to its 2018 levels.

The question is, can the TSX Venture stand on its own when they don’t?

Our ultimate guide to investing in gold stocks is a must-read resource to learn from data over the last several years and our tips and insights into reading potential investment opportunities in future.

Our ultimate guide to investing in gold stocks is a must-read resource to learn from data over the last several years and our tips and insights into reading potential investment opportunities in future.