Lords of Finance by Liaquat Ahamed won a Pulitzer Prize for its detailed and entertaining breakdown of the lead up to the Great Depression, and its aftershocks. The book focuses on the decision making from four critical central banks (England, France, the United States, and Germany) and how the men leading these financial institutions were not the stoic figures we might imagine. These central bankers were often troubled, mentally or physically, ill-equipped to counter a failing economy, and often mixed politics with monetary policy – a big no-no in today’s central banking world.

Lords of Finance is one of those books that will leave you economically smarter after reading. And the lessons learned will provide context for many of today’s monetary abnormalities (negative rates and excessive money printing). It focuses on a particular era nearly 100 years ago but will remain timeless and educational forever.

In finance, anyone, be it a retail investor, investment banker, or lender, who ignores history does so at their own peril… consider this book to be an invaluable history lesson.

4 Lessons Learned From Lords of Finance

Flaws in the gold standard: Before reading Lords of Finance, I was a firm supporter of a gold standard, albeit a skeptic that it will ever be enacted again. However, after reading this book, I came to appreciate the Keynesian perspective better when it comes to money. John Maynard Keynes is a crucial figure in the book.

The fiat money we use today (which is backed by nothing but faith in the economy whose central bank created it), came to be due to the crisis of the Great Depression. It was out of desperation (dropping the gold standard), but the logic behind fiat money had good intent.

Of the four major central banks, none wanted to get off the gold standard. The thought of leaving the gold standard kept them up at night, frankly. Nevertheless, they were desperate to revive their economies and the gold standard led to hoarding, which further exacerbated the economic challenges of the time.

So, after years of painstaking meetings, the gold standard was dropped, led by England and America.

After reading Lords of Finance, I don’t think we can ever go back to a gold standard unless it is out of desperation due to out of control, loose monetary policy that leads to a currency crisis in virtually every major economy. In other words, unless shit hits the fan simultaneously with the euro, yuan, USD, and pound, it will not happen.

Mixing monetary policy with political agendas is catastrophic: In order to have a fundamentally strong fiat currency, a country’s central bank needs to act independently from politics. Full stop.

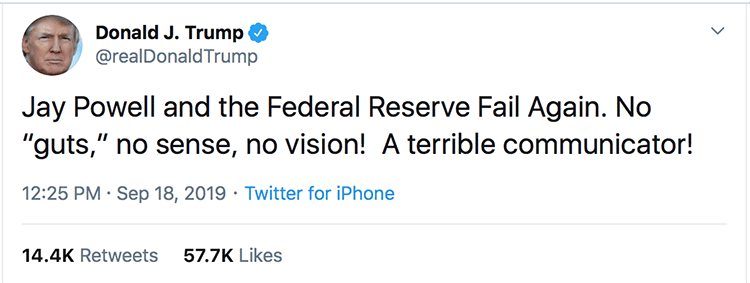

This is a timely reminder given Trump’s recent tweets that scolded Fed Chairman Powell.

It’s dangerous for a government to have sway with a central bank. It can mold the critical financial institution into a tool for short-term political gains. Thinking short-term is the demise of any fiat currency.

Money, specifically fiat money, needs to be controlled with the long-term in mind (planning should be based on decades, not months or years), or it is doomed. That, of course, is a tall order. After all, every fiat in the history of humanity has inevitably failed.

Central bankers were viewed suspiciously: Back in the twenties and thirties, central banks were viewed with a ton of skepticism and distrust by politicians and even the general public.

Heads of central banks were followed around by the media everywhere they went. Journalists hoped to unearth their next policy meeting or cooperation between, for example, England’s central bank chief Montagu Norman and America’s Benjamin Strong.

Not helping their public image, the central bankers in that day operated with the utmost secrecy and made little time for the press — a stark contrast to today when central bankers routinely engage in interviews with the financial media.

Today’s central bankers firmly believe in a strong communication strategy with the public, essentially telegraphing in advance their monetary policy.

It was not like this back in the twenties and thirties as their operations were more cloak and dagger.

Overburdening a powerful country with debt is dangerous for the world: Extremism rises when the masses are desperate and destitute. Germany, back in the late twenties and early thirties, was no exception.

After World War 1, the allies saddled Germany with debt to pay back the nations it had damaged – namely France and England. While that concept is undoubtedly reasonable (paying the winning countries money for starting a war that you lost), the amount of debt France insisted Germany pay would be the modern-day equivalent of over $2 trillion.

Against the Americans and British wishes, France barely budged on how much money they wanted from Germany (it was a bitter feud between France, America, England, and Germany). The sum France wanted from Germany was impossible to pay off for the Germans and hampered the nation’s ability to grow its economy during the twenties and thirties.

It caused Germany to contract while other nations rebuilt and began to grow again. German people were losing everything from their optimism for the future, family homes, and even their ability to get proper nutrition.

In such an environment, it didn’t take long for the Germans to get desperate and look for a change in leadership. Hitler came to power during this time of desperation. Before the German economic collapse, the people of Germany, by and large, viewed Hitler as a complete joke… a fringe politician with no following.

Lords of Finance Provides Clarity for Investors

Lords of Finance is one of those ‘must-reads’ for anyone involved in the capital markets. The parallels drawn with today’s economy and the roaring twenties will become obvious when reading; and the similarities between the thirties and the 2008 crash are very educational. What’s more, this book masterfully explains how the monetary policy we know and use today came to be during that volatile era nearly one hundred years ago.

Stay hungry,

Aaron

PS – Sign up for our newsletter if you like this read. Only our best content will land in your inbox. Hit the subscribe button below to get your free subscription (scroll down and you’ll see it)…